Bitcoin’s price is set to reach $125,000 as rising gold values and shrinking inflation fears reshape investor sentiment, supporting expectations of interest rate reductions and heightened interest in alternative investments.

Key points:

- Over $313 million in short Bitcoin positions were liquidated, indicating a potential for a short squeeze.

- Gold’s uptrend is drawing investors to alternative assets as expectations for interest rate cuts strengthen.

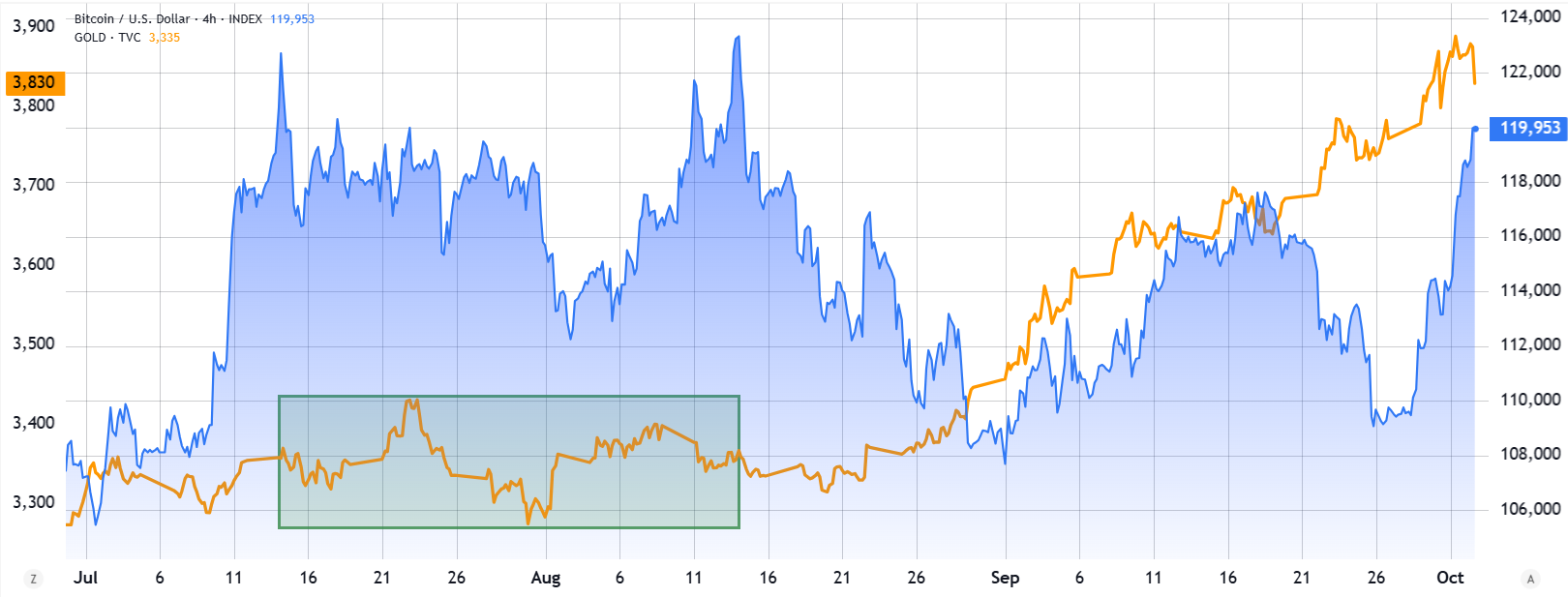

Currently, Bitcoin (BTC) has approached $121,000, the highest it has been in seven weeks, and traders are optimistic, given that market conditions are now more favorable compared to mid-August when it nearly hit $124,000 again. With recession fears easing and the steady momentum in gold, traders were likely unprepared for the current spike, often leading to conditions favorable for a short squeeze.

Market Analysis

Market Analysis Source: TradingView / Cointelegraph

Market Analysis

Market Analysis Source: TradingView / Cointelegraph

Gold faced stagnation near $3,400 for almost two months until mid-August, during which Bitcoin skyrocketed to its peak. Balancing out the temporary reduction in import tariffs — which ended on August 12 — the impact on the US trade was not significant, thus enhancing inflationary expectations.

Improved Inflation Outlook and Gold’s Rally Favor Bitcoin

The latest US Personal Consumption Expenditures Price Index showed a 2.9% increase from August, aligning with predictions by analysts. The decreased urgency around inflation has traders believing that the Federal Reserve plans to follow through with additional interest cuts. Traders who bought Bitcoin over $120,000 in August were left dissatisfied, especially since the recent import tariffs have not adversely affected the US trade balance or retail sales in the short term.

Simultaneously, Bitcoin’s rise in October has coincided with a 16% surge in gold prices within a month, while data from the World Gold Council indicates ongoing purchases by central banks.

CME FedWatch

Implied Fed Rate Odds Source: CME FedWatch

CME FedWatch

Implied Fed Rate Odds Source: CME FedWatch

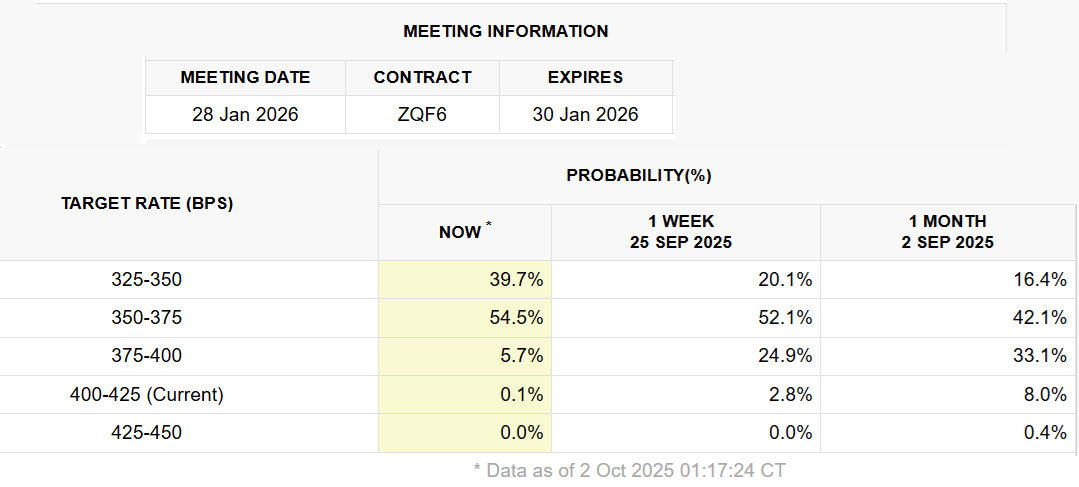

According to the CME FedWatch tool, the likelihood of the Federal Reserve reducing rates to 3.50% or less by January 2024 now stands at 40%, compared to 18% back in mid-August. Although the current inflation trends might be welcomed, persistent weaknesses in the labor market could put pressure on the recent S&P 500 peak amidst uncertainties related to possible US government shutdowns.

Earlier this week, Federal Reserve Vice Chair Philip Jefferson raised concerns about the labor market, suggesting it could suffer if it remains unsupported due to multiple pressures stemming from the trade, immigration, and other policies from President Trump. Jefferson posited that these effects will become more evident in the coming months, nudging traders to consider alternative hedging strategies.

Bitcoin Derivatives Reducing Sell Pressure

Over the preceding three days leading up to Bitcoin’s record high in mid-August, traders indicated near-equivalent odds for price movements. However, the current indicators signify a moderate fear of correction, with sell options trading at a higher cost than buy options. Over $313 million in leveraged short Bitcoin futures positions were liquidated in a short span, verifying that the over $120,000 rally caught many by surprise.

Moreover, with the surge in confidence stemming from the successful sale of OpenAI’s shares at a staggering $500 billion valuation, the heightened scrutiny surrounding the AI sector seems to be subsiding. Investors are beginning to view potential interest rate cut expectations positively, seeing diminishing risks of a stock market correction, and thus making the climb towards $125,000 increasingly plausible for Bitcoin. Meanwhile, gold’s consistent rise depicts traders’ preference for alternatives to conventional markets.