Bitcoin Surges While DeFi Expands; Zcash Leads the Market

The cryptocurrency market experienced a substantial recovery, with Bitcoin expected to reach new heights amid growing interest in safe-haven assets.

Cryptocurrency Market Recovers Post-September Slump

The digital asset sector bounced back impressively over the previous week following a decline at the end of September. Investor confidence has reignited, particularly due to an increased interest in safe-haven assets driven by the recent uncertainty stemming from the US government’s inaugural shutdown in six years.

The yearning for safe-haven investments hints at a potential rally for Bitcoin (BTC), possibly matching gold’s surge and even achieving a target of $150,000 before the year concludes, as suggested by Charles Edwards, founder of Capriole Investments. Bitcoin broke the $120,000 barrier earlier this week, marking a rise not seen since August 14, with trades hovering around $120,122 at the time.

In France, the escalating financial deficit of the central bank might serve as another catalyst for Bitcoin as it could lead to trillions in euros injected into the economy by the European Central Bank (ECB), instigating fresh liquidity for Bitcoin, according to Arthur Hayes, co-founder of BitMEX.

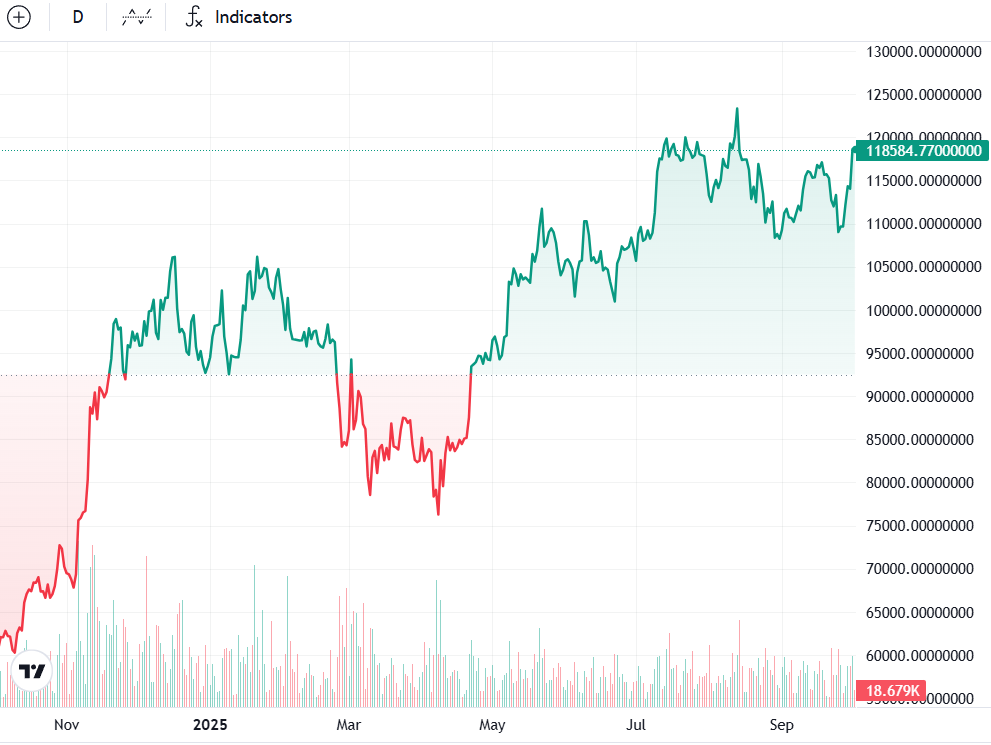

BTC/USD, one-day chart. Source: Cointelegraph

BTC/USD, one-day chart. Source: Cointelegraph

Predictions of a Bitcoin Surge by Charles Edwards

Charles Edwards contends Bitcoin might achieve a historical high of $150,000 before the conclusion of 2025 as investors lean towards safe-haven assets like gold. He stated during an interview that the recent recovery above $120,000 could lead to a very quick move to $150,000. According to recent data, Bitcoin climbed over 6% this past week, surpassing $118,500 for the first time since August 15.

BTC/USD, one-month chart. Source: Cointelegraph

BTC/USD, one-month chart. Source: Cointelegraph

Edwards’ outlook, however, is more cautious compared to some analysts forecasting Bitcoin could transcend $200,000. André Dragosch from Bitwise Asset Management indicated that the integration of cryptocurrency in US 401(k) retirement plans could unleash up to $122 billion in new investments, potentially pushing Bitcoin past the historic mark before year-end.

Cathie Wood’s Insights on Hyperliquid

ARK Invest’s CEO, Cathie Wood, draws parallels between Hyperliquid’s potential and the initial phase of Solana’s success, describing it as the new kid on the block. She recognizes Solana’s significant achievements, stating, “It’s exciting. It reminds me of Solana in the earlier days…Solana has proven its worth.”

ARK Invest’s current portfolio consists of Bitcoin, Ether (ETH), and Solana (SOL). Wood elaborated that they are exposed to Solana through Breera Sports, linked with the Solana treasury and supported by investors from the Middle East, with advisory ties to economist Art Laffer.

Although Wood didn’t confirm any stake in Hyperliquid, she labeled it a project to monitor closely. As competition between perpetual futures decentralized exchanges (DEXs) intensifies, especially after Aster’s token launch, the stakes are high.

Roman Storm’s Legal Battle

Roman Storm, co-founder of Tornado Cash, is fighting for acquittal on charges of unlicensed money transmission. Legal documents filed on September 30 argue that prosecutors did not satisfactorily demonstrate his intent to aid bad actors in misusing Tornado Cash. His defense states that failing to prevent misuse does not equate to willful wrongdoing.

Tornado Cash website. Source: Tornado.Cash

Tornado Cash website. Source: Tornado.Cash

His motion aims to dismiss charges as the prosecution’s evidence falls short legally.

SEC’s Move Towards Tokenized Stocks

Rob Hadick from Dragonfly highlights that while tokenized stocks will likely benefit traditional markets, the predicted gains for the crypto industry remain uncertain. Hadick spoke at the TOKEN 2049 conference, expressing skepticism about major crypto players benefiting from real-world asset tokenization.

The US SEC is reported to be drafting plans allowing blockchain-based stock trading on crypto exchanges, with financial firms advocating for continuously open markets. Institutions prefer not engaging directly with general-purpose chains, aiming to maintain control over their economics and execution environments.

Rob Hadick speaking at TOKEN 2049. Source: Andrew Fenton/Cointelegraph

Rob Hadick speaking at TOKEN 2049. Source: Andrew Fenton/Cointelegraph

The Future of Centralized Exchanges

According to 1inch co-founder Sergej Kunz, centralized exchanges may fade away over the next decade as decentralized finance aggregators gain prominence. In discussions at Token2049, Kunz noted this transition could extend over 5 to 10 years, arguing that centralized exchanges are limited markets, unlike 1inch which operates as a global liquidity hub.

Sergej Kunz at Token2049. Source: Cointelegraph

Sergej Kunz at Token2049. Source: Cointelegraph

DeFi Market Snapshot

Data from Cointelegraph Markets Pro and TradingView indicates most of the top 100 cryptocurrencies closed the week positively. Privacy-focused Zcash (ZEC) saw a remarkable increase of over 157%, leading the week’s performance, followed by DeXe (DEXE) with a 34% weekly rise.

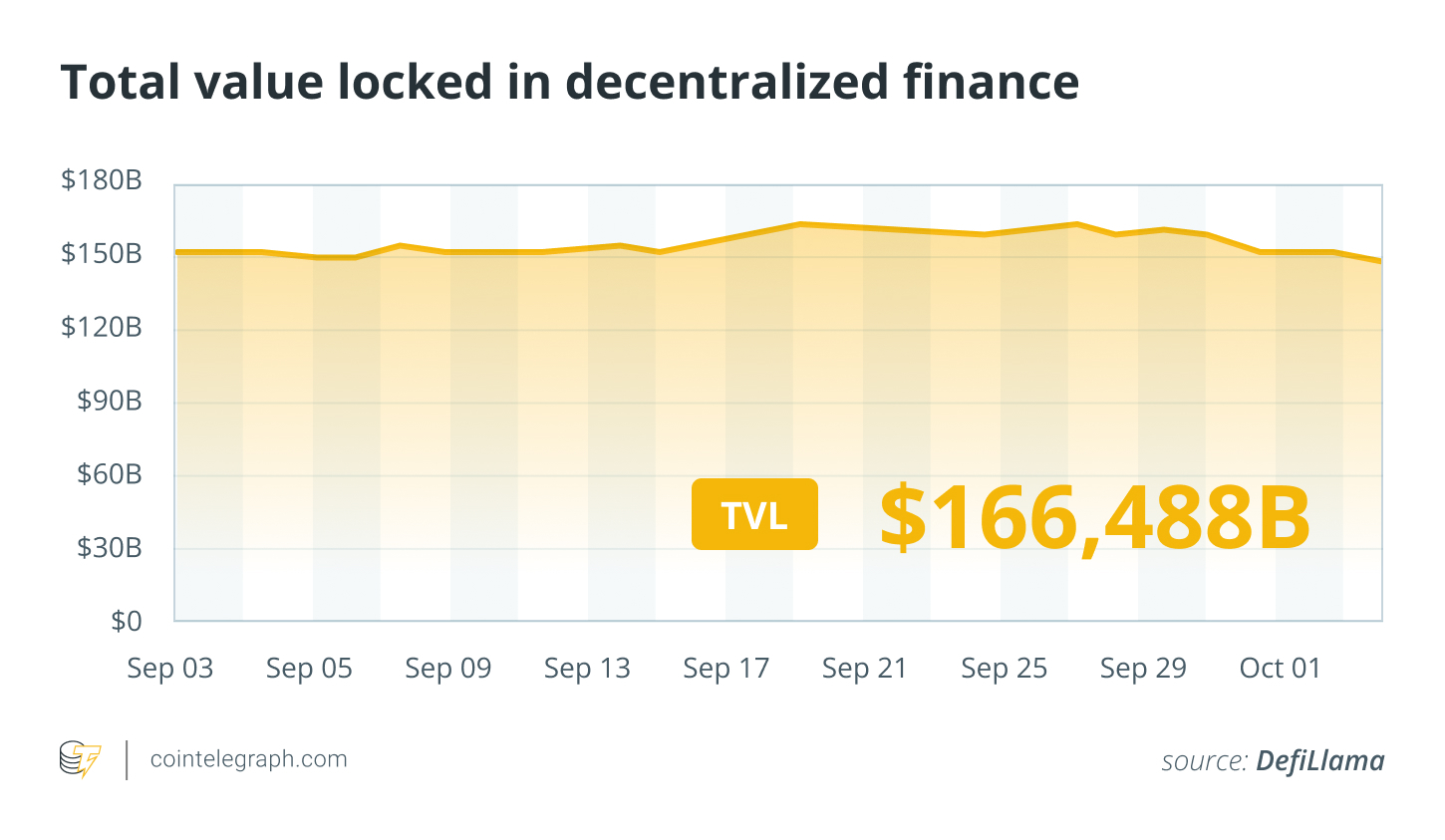

Total value locked in DeFi. Source: DefiLlama

Total value locked in DeFi. Source: DefiLlama

Thank you for reading our weekly overview of the most notable developments in DeFi. Join us next Friday for updates, insights, and educational content related to this rapidly evolving sector.