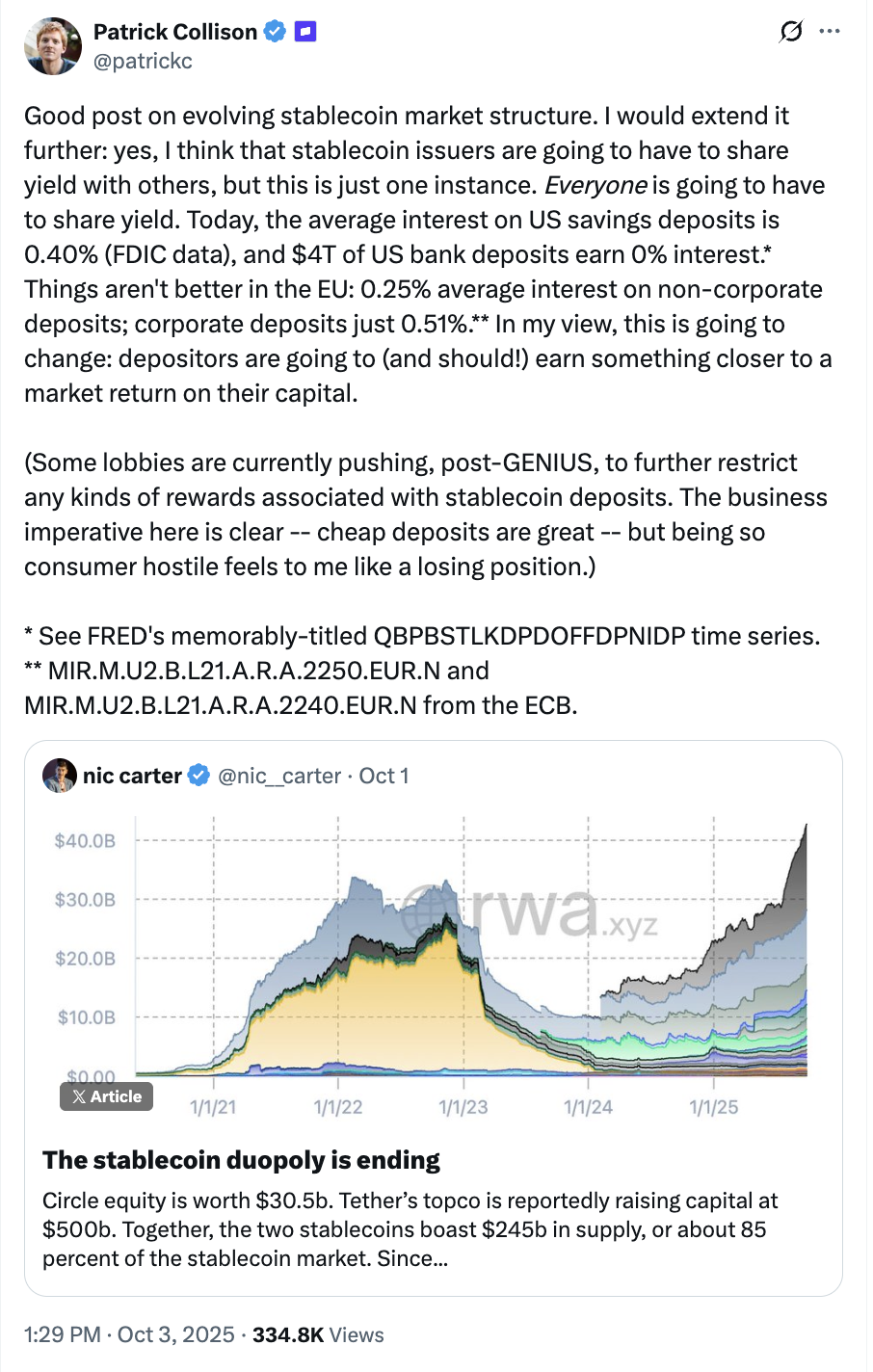

Stripe CEO: Traditional Banks Must Adapt to Yield-Bearing Stablecoins

Patrick Collison emphasizes that yield-bearing stablecoins will compel banks to provide better returns on customer deposits.

Yield-generating stablecoins are set to compel traditional banks and legacy financial organizations to provide real yields on deposits in order to stay competitive. According to Stripe CEO Patrick Collison, this shift is essential in light of current interest rates.

Currently, the average interest rate for savings accounts in the US is 0.40%, while in the EU it stands at 0.25%. These comments came in response to discussions prompted by VC Nic Carter regarding the ascent of yield-bearing stablecoins. Collison added:

“Depositors are going to, and should, earn something closer to a market return on their capital. Some lobbies are currently pushing post-GENIUS to further restrict any kinds of rewards associated with stablecoin deposits. The business imperative here is clear — cheap deposits are great, but being so consumer-hostile feels like a losing position.”

Patrick Collison

Source: Patrick Collison

Patrick Collison

Source: Patrick Collison

Stablecoins have seen significant growth in both market cap and acceptance since 2023, catalyzed by the introduction of the GENIUS stablecoin bill in the United States, which facilitated a managed stablecoin industry but also restricted yield-sharing.

Pushback from the Banking Sector

The banking sector has resisted interest-bearing stablecoins, arguing to US lawmakers that allowing such products would threaten the banking system and reduce their market share. New York Senator Kirsten Gillibrand expressed concerns at the DC Blockchain Summit in March, saying:

“Do you want a stablecoin issuer to be able to issue interest? Probably not, because if they are issuing interest, there is no reason to put your money in a local bank.”

Conversely, executives within the crypto sphere view the rise of stablecoins as the next step towards the evolution of fiat payments, predicting that fiat currencies themselves will essentially become stablecoins, simply referred to by traditional names like dollars, euros, or yen.