Key Takeaways:

- The total market cap for alternative cryptocurrencies (TOTAL3) reached a historic high of $1.18 trillion, indicating a strong upward trend.

- A noticeable decline of 11.8% in USDT dominance suggests a shift of investor interest towards riskier assets.

TradingView ticker TOTAL3, which monitors the market cap of all cryptocurrencies excluding Bitcoin and Ether, achieved a new milestone on Monday. This also reflects its highest weekly close, surpassing previous records from 2021.

TOTAL3 market cap

TOTAL3 market cap. Source: Cointelegraph/TradingView

TOTAL3 market cap

TOTAL3 market cap. Source: Cointelegraph/TradingView

Traders utilize the TOTAL3 chart to assess the health of the altcoin market, as this combined valuation exposes patterns of capital shifts and the robustness of the broader altcoin ecosystem.

The speculation of an altseason is intensified as USDT dominance has decreased, stirring speculation about capital flow from stablecoins to riskier investments, which generally signals growing confidence in the market. A drop below 4% would mark the lowest USDT dominance since January 2025.

USDT dominance weekly chart

Source: Cointelegraph/TradingView

USDT dominance weekly chart

Source: Cointelegraph/TradingView

Crypto trader Honey expressed positive sentiment in discovering a breakout from a cup-and-handle pattern on the weekly chart, asserting:

“We have officially broken out of the cup and candle, which is extremely bullish for our beloved altcoins. expect fireworks in the coming weeks. TOTAL3 to $1.6T.”

TOTAL3 weekly analysis by Honey

Source: X

TOTAL3 weekly analysis by Honey

Source: X

Data Signals a Gradually Emerging “Altseason”

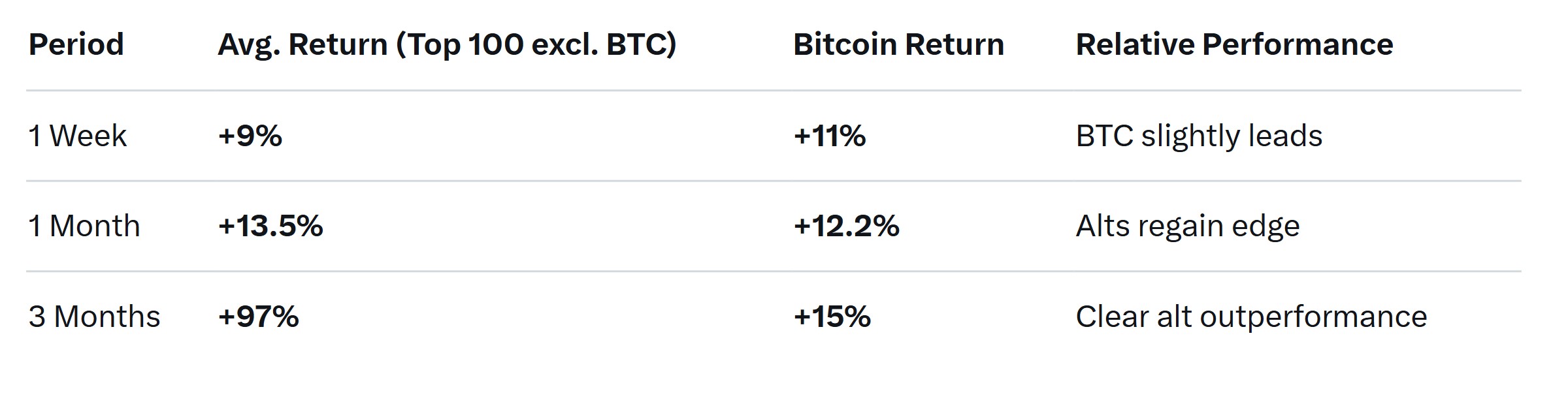

Analysis of the top 100 crypto assets reflects a growing strength in this developing altseason cycle, with returns on altcoins exceeding Bitcoin’s by over six times in the last three months. While Bitcoin remains a key anchor, investor interest is evidently shifting towards riskier options.

Top 100 excluding BTC average returns data

Source: Cryptobubbles/Cointelegraph

Top 100 excluding BTC average returns data

Source: Cryptobubbles/Cointelegraph

Currently, only 60% of returns for the leading 100 cryptocurrency assets are from altcoins, which is below the typical range of 80-90% that signals a confirmed altseason.

Simultaneously, the altcoin season index has risen to 69%, nearing the critical level of 75% that would signify widespread altcoin prevalence.

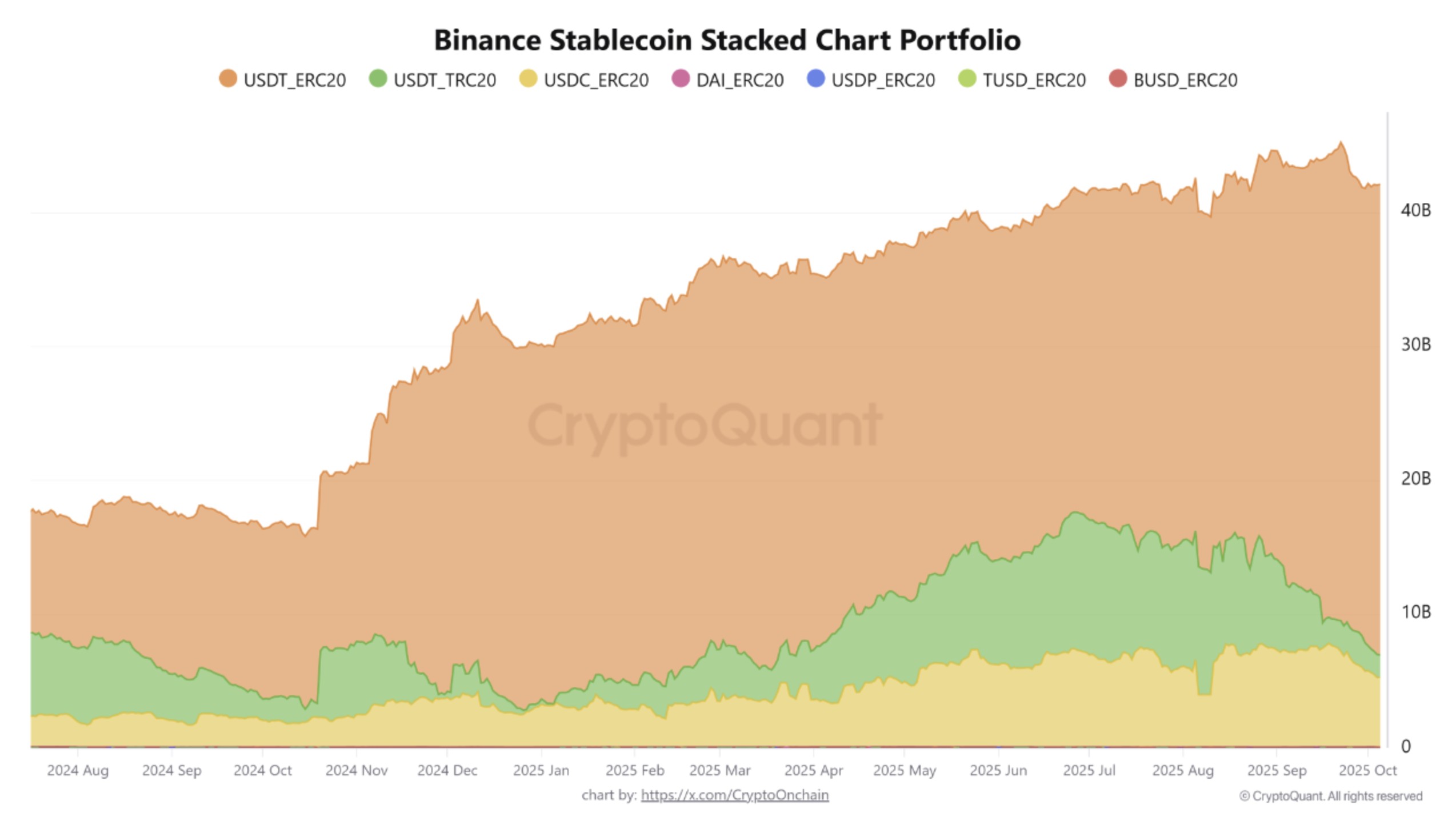

Adding some caution, reports indicate a $4 billion net outflow in ERC-20 stablecoins since September 22, with Binance contributing $3 billion, which is 75% of the total outflow. Their stablecoin reserves dropped from $45 billion to $42 billion.

Binance Stablecoin reserves data

Source: CryptoQuant

Binance Stablecoin reserves data

Source: CryptoQuant

When investors capitalize on market gains, vast withdrawals are frequent indications. Reduced stablecoin quantities denote less available funds for purchasing, intensifying the market’s fragility to short-term price retractions.

This article is not financial advice. Investors are encouraged to conduct their own research before making financial decisions.