Bitcoin Faces Threat of Drop to $114K as Traders Apply Pressure on BTC Long Positions

Bitcoin’s recent price activity reflected a decline of over 4% from its all-time high, resulting in new predictions that the cryptocurrency could eventually reach a floor of $114,000. Despite the setback, market liquidity is beginning to recover, suggesting that volatility might remain a factor as traders react to price movements.

Key Highlights:

- A significant drop in Bitcoin’s price raises caution among traders.

- The market appears to be stabilizing, with increased liquidity on both bid and ask sides.

- Predictions indicate that Bitcoin might find support near $114,000, posing risks for positions held by traders.

Market Trends

Bitcoin’s attempts to bounce back above $122,000 played out against a backdrop of trading strategies involving considerable market volumes, where ‘predatory’ tactics appear to have influenced prices. Traders have been observing and reacting to market signals carefully, contributing to increasing open interest in derivatives markets.

BTC Price Movement

BTC/USD one-hour chart. Source: Cointelegraph/TradingView

BTC Price Movement

BTC/USD one-hour chart. Source: Cointelegraph/TradingView

The experienced trader Skew described the market’s current price movements and dynamics, pinpointing the tactics employed by larger traders to manipulate buying and selling.

Quote on Market Dynamics: “Very efficient price action tbh hence the low volatility thus far,” - Skew Translation: The market is demonstrating very effective price behavior, which explains the current low volatility.

As market conditions begin stabilizing, experts forecast a consolidation phase, indicating potential regions where Bitcoin might stabilize prior to any continued price recovery.

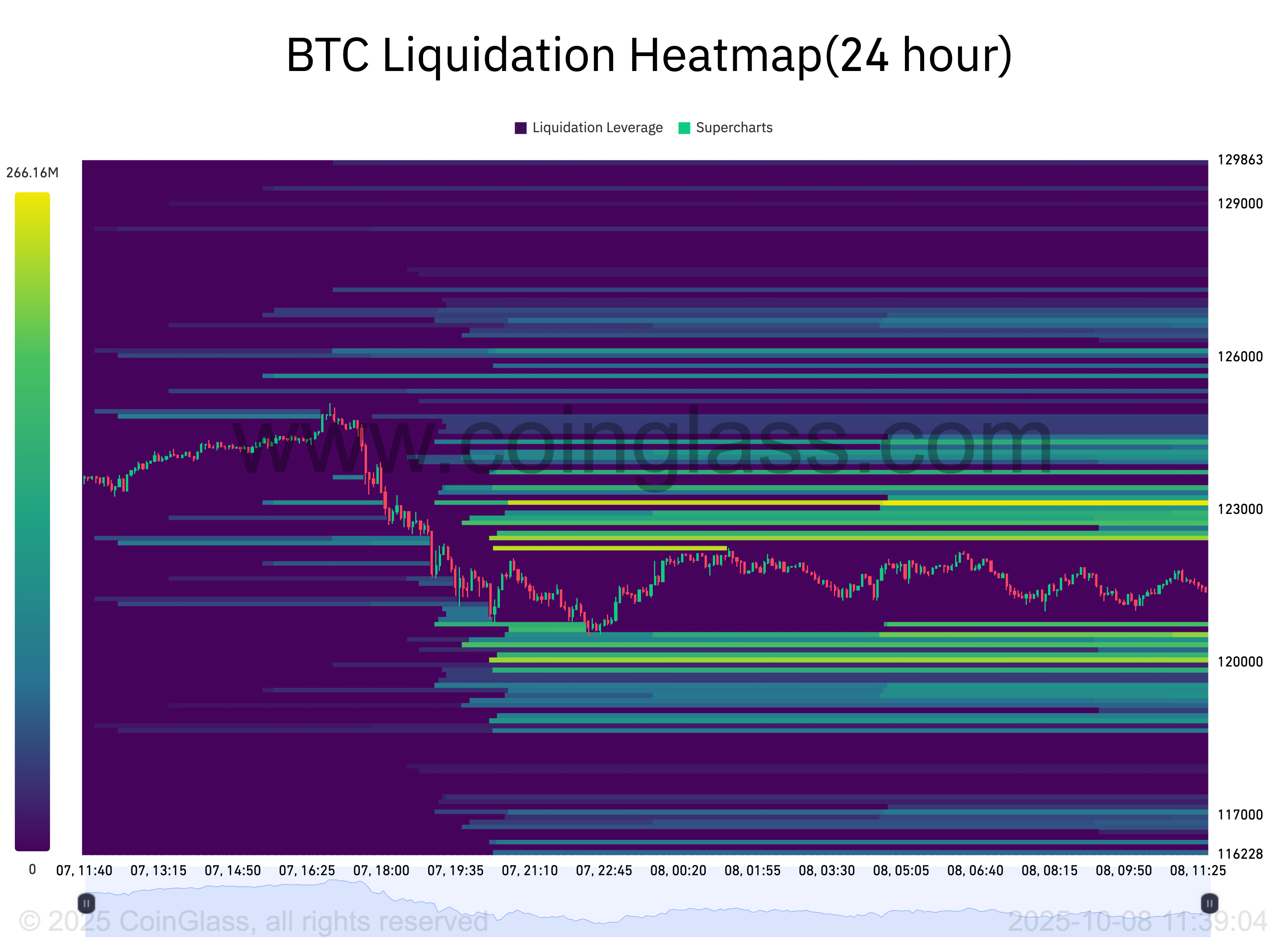

BTC Liquidation Heatmap

BTC liquidation heatmap. Source: CoinGlass

BTC Liquidation Heatmap

BTC liquidation heatmap. Source: CoinGlass

Other traders are assessing support levels closely, understanding that without adequate backing, price could decline sharply.

For crypto participants, all trading carries inherent risks, and market trends must be monitored diligently to mitigate potential losses.