New Buyers Propel 559,000 BTC Surge Over Three Months

A significant influx of new short-term holders has driven Bitcoin's value increase, marked by the addition of 559,000 BTC, as exchange activity declines.

Bitcoin’s recent ascension has captured the attention of numerous new buyers. In the last three months, short-term holders have collectively acquired 559,000 BTC. According to data provided by CryptoQuant’s Axel Adler Jr., the supply for short-term holders has increased from 4.38 million BTC to 4.94 million BTC.

New Wallet Growth Indicates Increased Demand

This rise in supply owned by short-term holders signifies a consistent influx of new buyers, which started after a low point in mid-2025 and has persisted amid favorable market prices.

Over the past quarter, short-term holders’ supply increased by 559K BTC, rising from a low of 4.38 million to 4.94 million BTC. A significant volume of new buyers entered the market. pic.twitter.com/eW3UsLDWUg

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 8, 2025

Bitcoin is currently hovering near its previous peak, demonstrating that transient holders are consistently increasing their cryptocurrency investments. This trend implies ongoing financial inflow into the market, even at elevated price points. A surge in short-term holdings may indicate the early stages of buying, which could transition to longer-term holding if the market remains stable.

Decrease in Exchange Activity Amid Rising Holdings

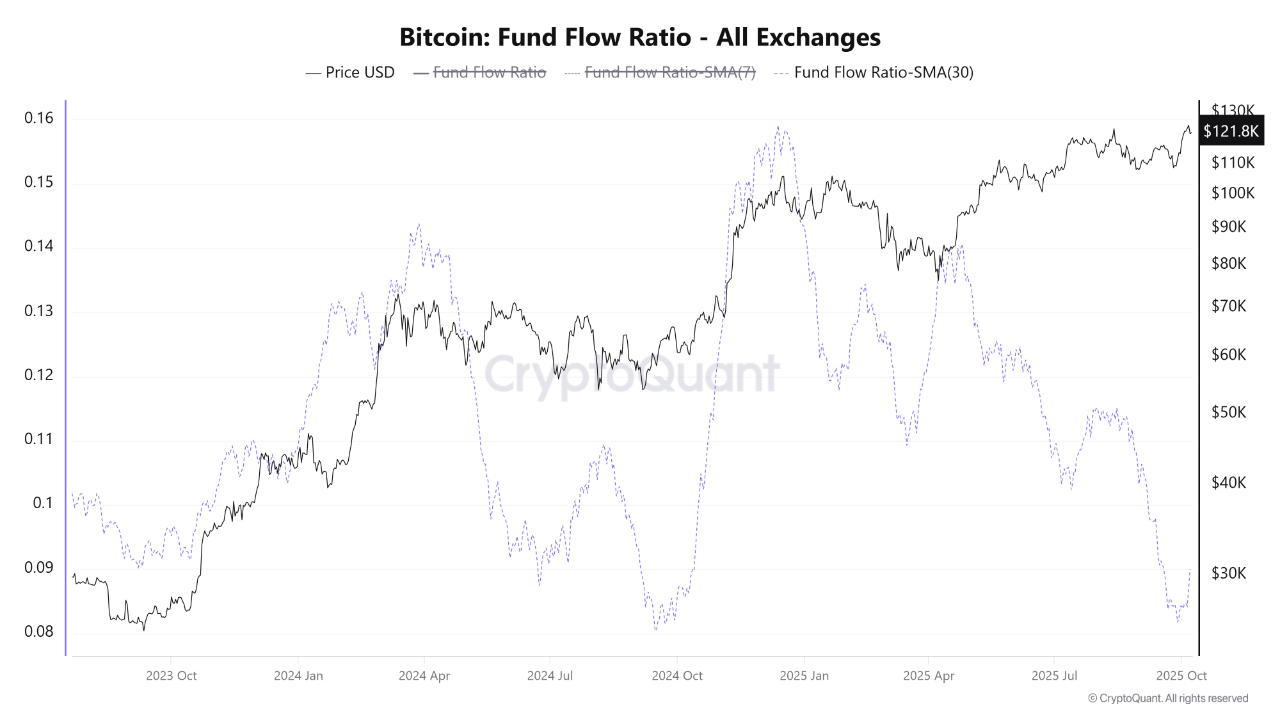

Recent on-chain data from CryptoOnchain reveals that the Fund Flow Ratio has dropped to its lowest level since July 2023, indicating a decrease in the volume of transactions associated with exchanges. This suggests that fewer coins are being moved onto or off trading platforms, with most transactions now taking place off-exchange, such as transfers to self-custody wallets and substantial over-the-counter transactions.

Market Outlook

Market analyst ZYN pointed out a vulnerability in the price zone between $120K and $121K, noting that there is little on-chain support available there.

Between $121K–$120K there isn’t much support, which means price can cut through quickly if selling picks up. — ZYN

However, just below this range, around $117K, approximately 190,000 BTC were recently acquired, indicating a likely point where buying interest might defend positions against price drops. Currently, Bitcoin trades around $121,400, down 2% over the last 24 hours, while the 7-day performance reflects a nearly 6% increase with considerable purchasing interest and reduced selling pressure across the network.