Despite XRP trading below $3, a combination of significant whale accumulation, optimistic developments around ETFs, and positive technical indicators may indicate a forthcoming rebound.

Key Highlights:

- Optimism surrounding several pending XRP ETF applications may elevate XRP prices.

- Whale investment is noteworthy: $1.1 billion in XRP has been accumulated despite negative sentiment from retail investors.

- A price breakout above $3.30 could lead to gains between 60% to 85%, as suggested by current chart patterns.

After surpassing $3 on October 2, XRP (XRP) faced difficulty maintaining momentum, dropping back to $2.84. This daily closing below the key psychological threshold indicated a loss of support from the 50-period exponential moving average, foreshadowing potential short-term weakness. Yet, numerous structural and blockchain indicators imply that XRP’s current challenges could be temporary, with various catalysts signaling a potential resurgence within the next few weeks.

XRP monthly chart

XRP monthly chart. Source: Cointelegraph/TradingView

XRP monthly chart

XRP monthly chart. Source: Cointelegraph/TradingView

Approvals for XRP ETFs Might Unlock Institutional Investments

October may be a crucial month for XRP as the SEC is approaching deadlines for 16 pending crypto ETF applications, including several spot XRP ETFs anticipated between October 18 and October 25. The regulatory atmosphere has changed since the SEC approved new generic listing standards in September 2025, simplifying the approval process for commodity-based ETFs.

All eleven XRP ETF proposals have passed their listing standards deadlines, heightening the chance of simultaneous approval. Analysts predict that if approved, these ETFs could attract between $3 billion and $8 billion in institutional investments, similar to the early phases of Bitcoin and Ether ETF adoption.

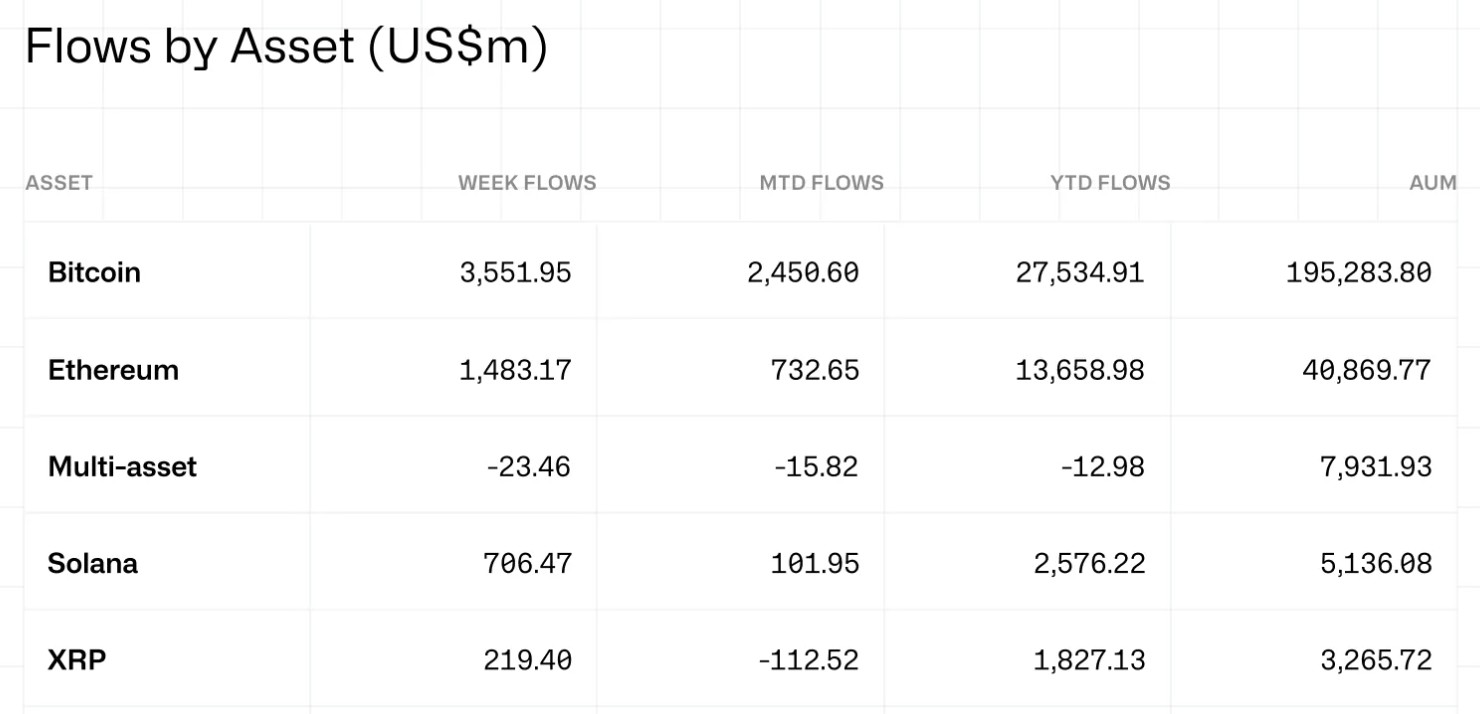

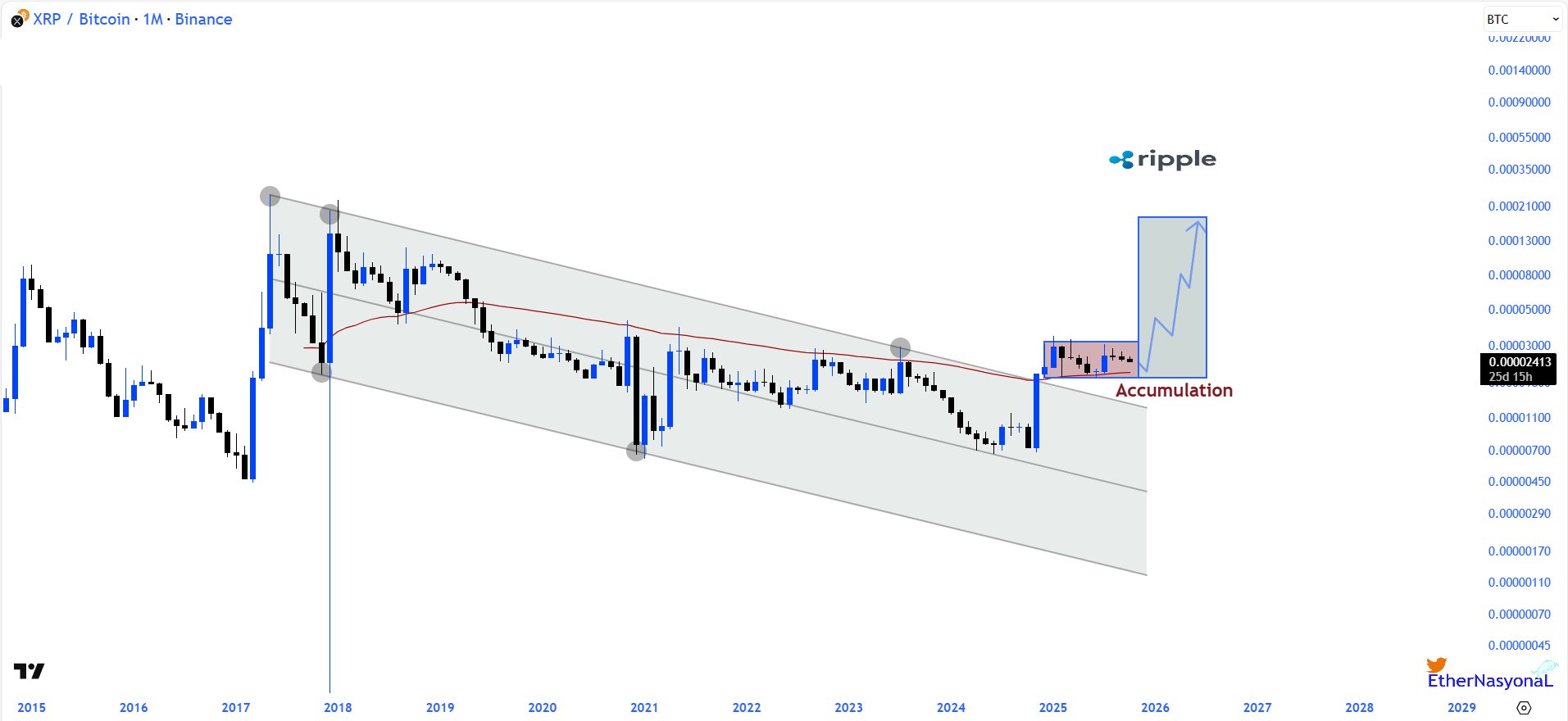

Data from CoinShares further supports this optimism, showing that XRP investment products saw $220 million in inflows last week, raising year-to-date inflows to $1.8 billion, with total assets under management reaching $3.2 billion.

XRP ETP flows by asset

XRP ETP flows by asset. Source: CoinShares

XRP ETP flows by asset

XRP ETP flows by asset. Source: CoinShares

Whale Accumulation Neutralizes Retail Doubt

Cointelegraph reported that XRP’s sentiment ratio shifted below 1.0, revealing that negative comments now eclipse positive ones on social media. Historically, such retail “fear, uncertainty, and doubt” (FUD) phases have preceded notable recoveries, as capitulation often signals market bottoms.

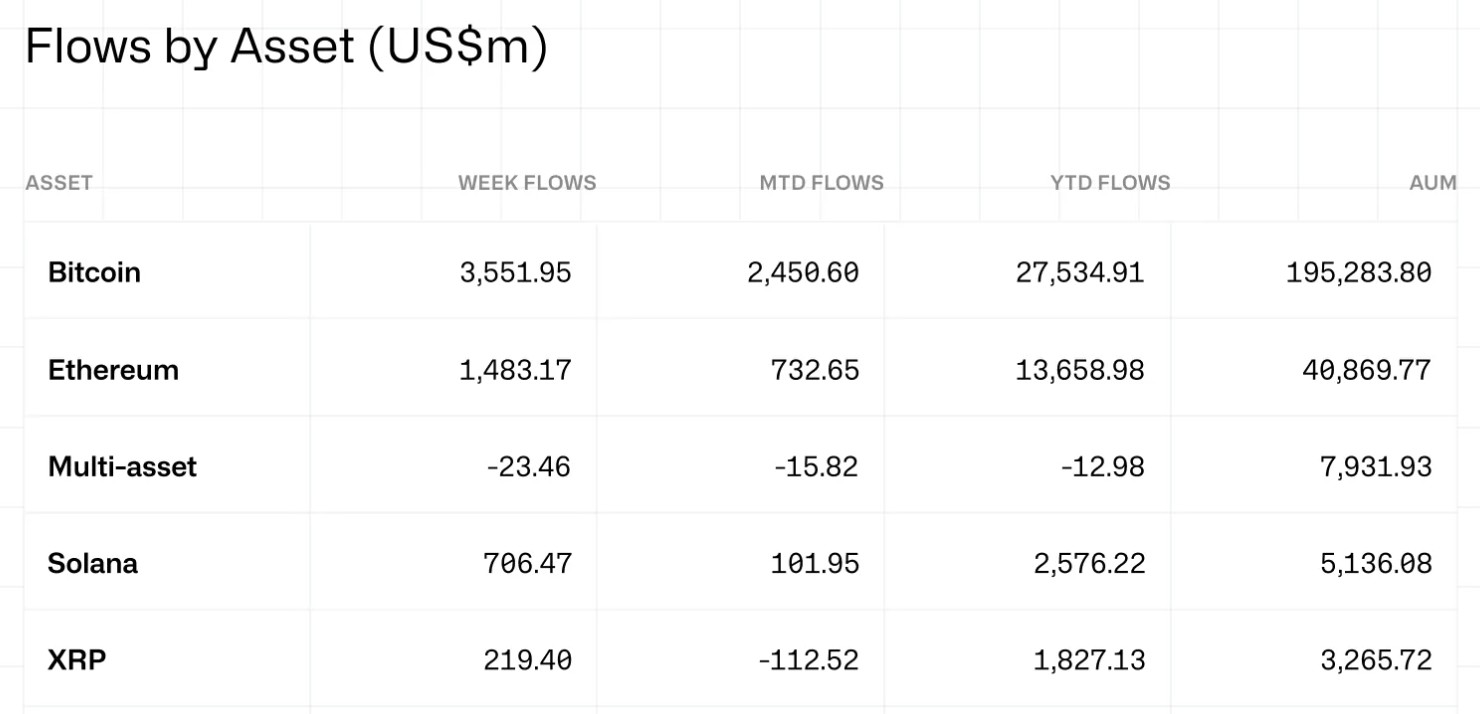

Meanwhile, large holders took advantage of the downturn. In the last three days, whales amassed 55 million XRP worth nearly $1.1 billion. Onchain data also indicated that the Net Holder Position Change has remained positive since August, showing consistent accumulation around the $3 barrier.

XRP Holder Net Position change

XRP Holder Net Position change. Source: Glassnode

XRP Holder Net Position change

XRP Holder Net Position change. Source: Glassnode

Trading Professionals Monitoring a Possible Climb to $5

Although XRP is currently consolidating, its price trend remains historically robust. The asset is maintaining its highest weekly and monthly closing range since exceeding its 2017 record.

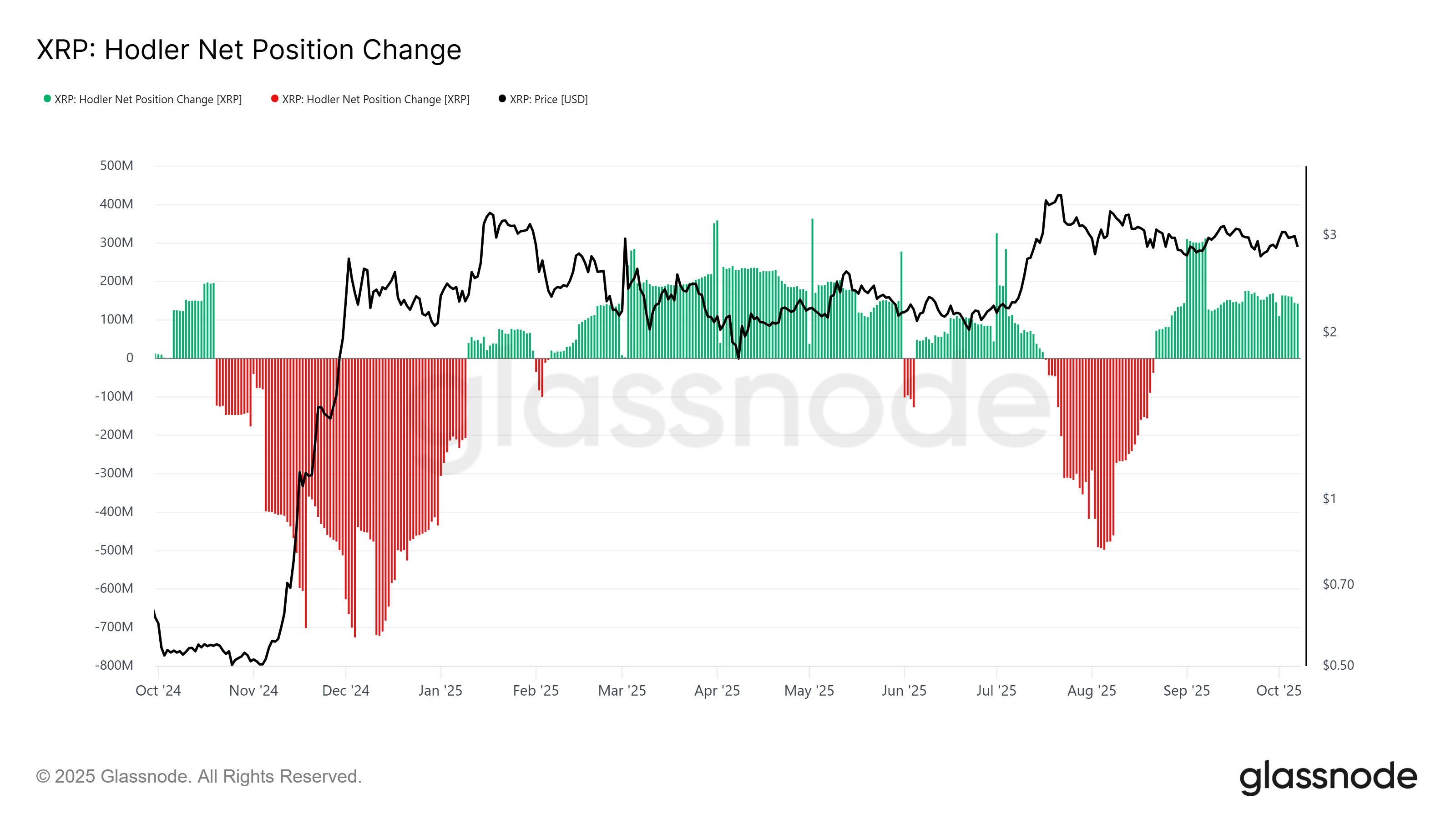

Additionally, crypto analyst EtherNasyonal mentioned that XRP’s descending channel against Bitcoin was broken late in 2024, indicating a significant structural transformation, with steady accumulation over the previous year.

XRP/BTC market strength

XRP/BTC market strength according to EtherNaysonal. Source: X

XRP/BTC market strength

XRP/BTC market strength according to EtherNaysonal. Source: X

This current trend resembles a bullish market fractal that could support gains of 60% to 85% if XRP breaks clearly above $3.30. Trader Dentoshi identified a similar formation, suggesting that extended consolidation might lead to a breakout.

XRP fractal pattern

XRP fractal pattern. Source: Dentoshi/X

XRP fractal pattern

XRP fractal pattern. Source: Dentoshi/X

However, trader Peter Brandt observed that a daily close below $2.65 could serve as a pivotal moment for XRP, confirming a descending triangle pattern. Brandt stated,

“IF it closes below $2.68743 (then I’ll be a hater), it should drop to $2.22163.”

XRP analysis by Peter Brandt

XRP analysis by Peter Brandt. Source: X

XRP analysis by Peter Brandt

XRP analysis by Peter Brandt. Source: X

This article does not provide investment advice or recommendations. All investments and trading actions come with risks, and readers should perform their own research when making decisions.