Bitcoin remains close to its three-week lows after an unprecedented $20 billion liquidation event rattled the crypto markets. Analysts caution that the bottom has not yet been reached and suggest potential further declines.

Key Highlights:

- Bitcoin and altcoins are reeling from the largest liquidation event in the cryptocurrency’s history.

- BTC’s price struggles to recover from recent lows as the $100,000 threshold looms closer.

- A trader indicates a beginning of a “cleanse” of the current bull-market exuberance.

Bitcoin (BTC) tested the $110,000 support level on Saturday following the aftermath of the record-setting liquidation.

BTC/USD one-hour chart. Source: Cointelegraph/TradingView

BTC/USD one-hour chart. Source: Cointelegraph/TradingView

Trader Points to a “Crypto Cleanse”

Data from Cointelegraph Markets Pro and TradingView revealed that BTC/USD was struggling to bounce back after dropping to three-week lows on Bitstamp. Concerns over the US-China trade war negatively affected risk assets, leading to a 2.7% decline in the S&P 500 on Friday, while gold prices rose above $4,000 per ounce.

XAU/USD one-hour chart. Source: Cointelegraph/TradingView

XAU/USD one-hour chart. Source: Cointelegraph/TradingView

In light of the volatility, Bitcoin’s relative strength index (RSI) indicated significant overselling, reaching levels not seen since early February’s trade war events.

BTC/USD one-day chart with four-hour RSI. Source: Cointelegraph/TradingView

BTC/USD one-day chart with four-hour RSI. Source: Cointelegraph/TradingView

A trader known as Skew commented on market behavior via X:

“Seeing a lot of short positioning rolling off here aggregately. Some passive buying ongoing mainly via Coinbase spot.”

Skew further noted that major exchanges also faced difficulties amid the downward trend.

Another trader, Roman, expressed skepticism regarding the continuity of the bull market and anticipated further decreases:

“This isn’t the bottom. There are over 30 million altcoins, many of which are scams. The expected crypto cleanse is underway.”

Total altcoin market cap (without top 10) one-week chart. Source: Cointelegraph/TradingView

Total altcoin market cap (without top 10) one-week chart. Source: Cointelegraph/TradingView

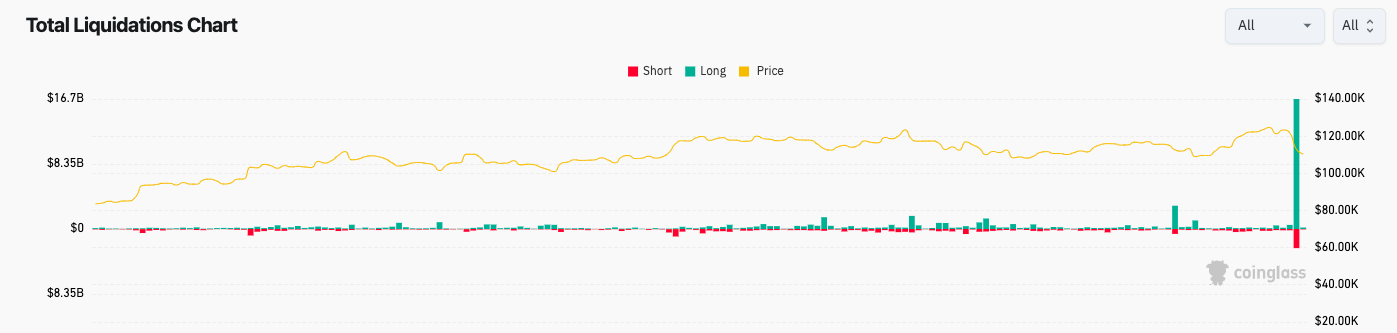

Liquidation Totals Exceeding $20 Billion

Betting on bullish movements resulted in the largest liquidation scenario ever experienced in the crypto market.

CoinGlass reported nearly $20 billion in liquidations within 24 hours, with long positions making up the majority. They indicated that the actual figure could be even higher, as Binance restricts their liquidation reporting to one order per second.

Crypto liquidations (screenshot). Source: CoinGlass

Crypto liquidations (screenshot). Source: CoinGlass

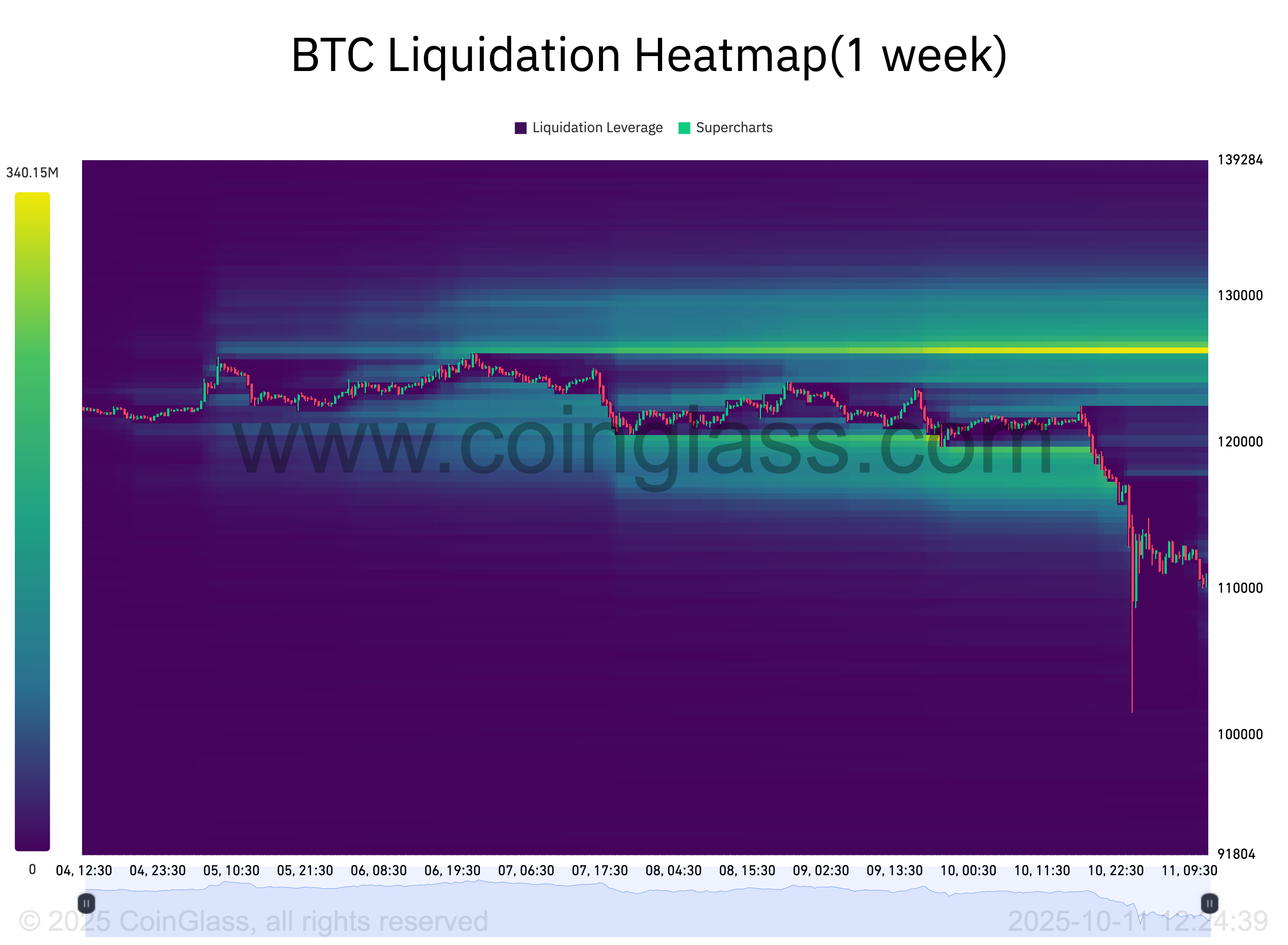

Current exchange order-book data shows a stark imbalance between buy and sell orders, with significant resistance at $120,000, while there is minimal support to counter a drop towards $100,000.

BTC liquidation heatmap. Source: CoinGlass

BTC liquidation heatmap. Source: CoinGlass

Earlier in the day, Cointelegraph analyzed expectations that BTC/USD could revisit the lower end of its local range, potentially down to $108,000 as part of a fluctuating price action.

Disclaimer: This piece does not offer investment advice. All trading involves risk; therefore, readers must conduct their own research.