Crypto Traders Link Market Decline to Trump's Tariffs, Santiment Highlights

Market experts note that the decline is attributed to broader issues than just tariffs.

Crypto retail investors quickly attributed Friday’s decline in the crypto market to US President Donald Trump’s announcement of a 100% tariff on China, as they frequently seek a singular event to explain market downturns, according to the sentiment analysis platform Santiment.

Analysts suggest, however, that the reasons for the market’s fall are more complex than just tariffs. “This is typical ‘rationalization’ behavior from retailers, who need to point to a singular event as the reason for a cataclysmic downturn in crypto,” Santiment stated in its report on Saturday.

Discussion around US-China tariffs increased among crypto participants.

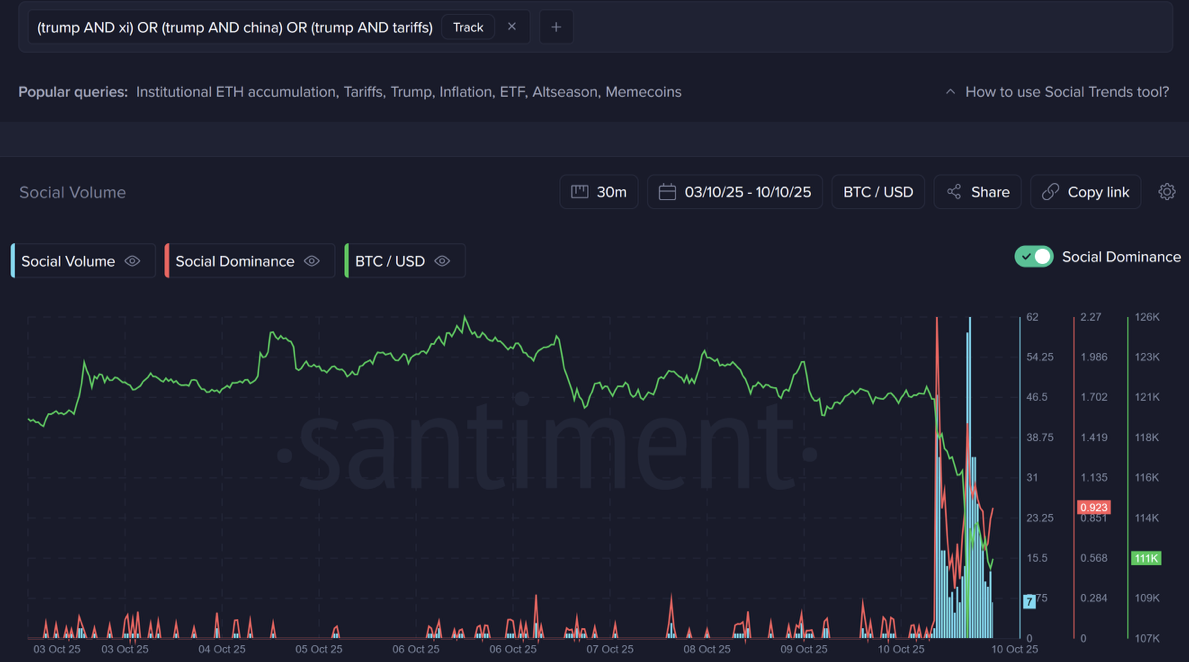

The spike in discussions around the US-China tariff concerns surged among crypto market participants. Source: Santiment

Discussion around US-China tariffs increased among crypto participants.

The spike in discussions around the US-China tariff concerns surged among crypto market participants. Source: Santiment

Santiment noted that the crash triggered a swift consensus on social media regarding the causes of the slump.

Importance of US-China Relations for Retail Investors

While the geopolitical event was a catalyst for the downturn, it was not the sole reason, as pointed out by analysts from The Kobeissi Letter. They attributed the issue to “excessive leverage and risk” in the crypto market. Around $16.7 billion in long positions were liquidated compared to just $2.5 billion in shorts, reflecting a nearly 7-to-1 ratio.

Bitcoin (BTC) plummeted more than 10% within 24 hours following Trump’s announcement, with the BTC/USDT futures pair trading at as low as $102,000.

Bitcoin is trading at $109,910 at the time of publication, down 10.06% over the past week.

Bitcoin is trading at $109,910 at the time of publication, down 10.06% over the past seven days. Source: CoinMarketCap

Bitcoin is trading at $109,910 at the time of publication, down 10.06% over the past week.

Bitcoin is trading at $109,910 at the time of publication, down 10.06% over the past seven days. Source: CoinMarketCap

Santiment emphasized that developments between the US and China will play a crucial role in shaping retail investors’ trading strategies in the near future.

Predictions for Bitcoin Prices

If negotiations between Trump and Xi yield positive results, retail sentiment toward crypto may improve. Conversely, escalating tensions could lead to more pessimistic market forecasts. “Expect for the ‘Bitcoin sub-100K’ prediction floodgates to begin opening up,” Santiment added, stating:

“Bitcoin, whether we like it or not, is behaving more like a risk asset than a safe haven during times of country tensions.”

Sentiment fell sharply following the market decline, with the Crypto Fear & Greed Index dropping to a “Fear” level of 27 in Saturday’s update, a significant drop from Friday’s “Greed” level of 64, marking the lowest point in nearly six months.

Related: Market crash ‘does not have long-term fundamental implications’ — Analyst