Key Highlights:

- The distortions in ETH’s perpetual contracts are diminishing, with monthly futures indicating a neutral stance alongside reduced market fear.

- The options market showcases equal demand for both bullish and bearish positions, signaling a healthy derivatives environment.

- During the latest crash, ETH showed stronger performance compared to many altcoins, which strengthens its bullish tendencies.

Ether (ETH) has returned to the $4,100 mark following the substantial 20.7% decline from the previous Friday. This recovery follows significant liquidations in long positions, totaling $3.82 billion, with indicators suggesting that a return to the support level of $3,750 signals the end of this recent downturn.

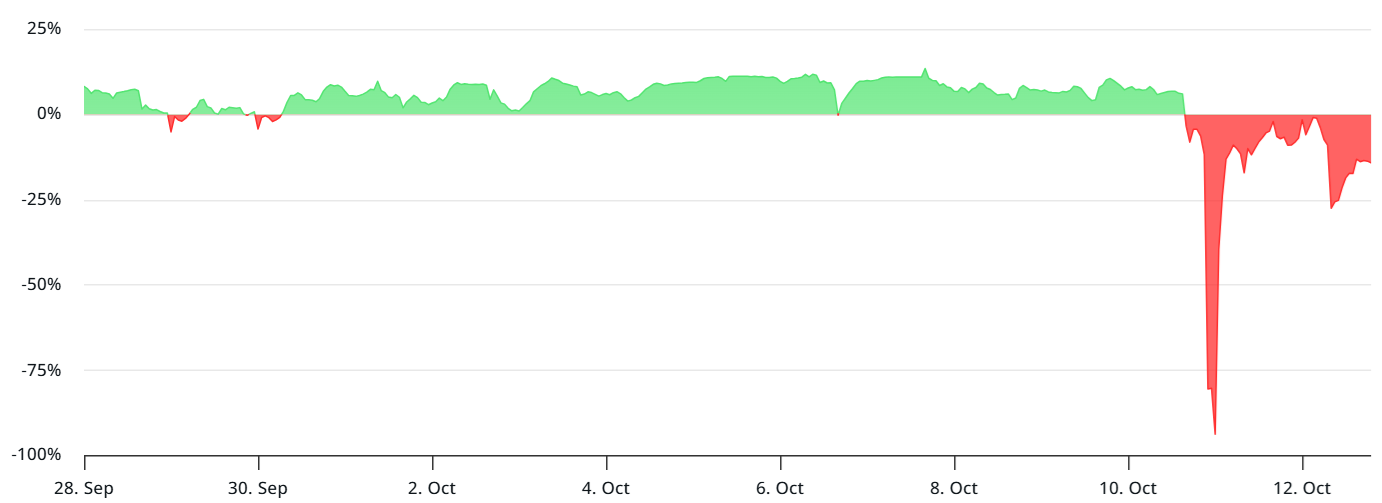

ETH perpetual futures annualized funding rate. Source: laevitas.ch

ETH perpetual futures annualized funding rate. Source: laevitas.ch

The funding rate on ETH perpetual futures fell to -14%, meaning those betting against the market face additional costs, an unsustainable situation in the long run. This environment is likely rooted in concerns over the stability of certain market players or exchanges, provoking traders to exercise caution.

ETH Derivatives Point Toward Recovery

Market apprehensions linger around potential compensation for clients related to cross-collateral margin challenges and oracle price issues. Binance has stated it will compensate $283 million while still reviewing numerous additional cases.

Market participants are likely to retain a conservative approach until further clarity is provided. Meanwhile, wrapped tokens and synthetic stablecoins have suffered significant losses, reducing traders’ margins by approximately 50% rapidly.

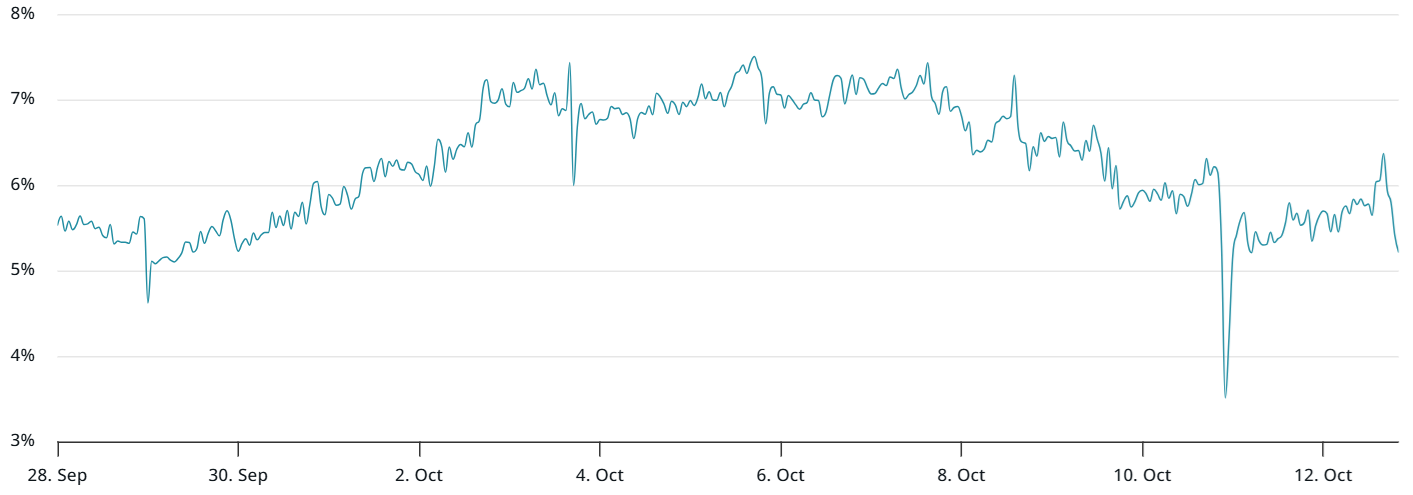

ETH 60-day futures premium

ETH 60-day futures premium

ETH monthly futures adjusted to the sudden turmoil within two hours, quickly recovering the 5% premium required for neutrality. The current trend of limited interest in bullish leveraged positions reflects more on product inefficacy rather than prevailing bearish sentiments.

This market discrepancy might persist until confidence among market makers is restored, a process that could span weeks to months and doesn’t necessarily indicate a downturn for ETH prospects.

ETH options put-to-call ratio

On the Deribit exchange, Ether’s options market remains healthy, showing no signs of strain. Weekend trading activity matched normal levels, with put options seeing slightly less activity than call options, underscoring a balanced market.

This data alleviates fears regarding a coordinated crash within the cryptocurrency realm. An uptick in options trading volumes would likely signal anticipation of a price nosedive, but the unexpected liquidation events caught traders unprepared.

ETH’s Durable Performance

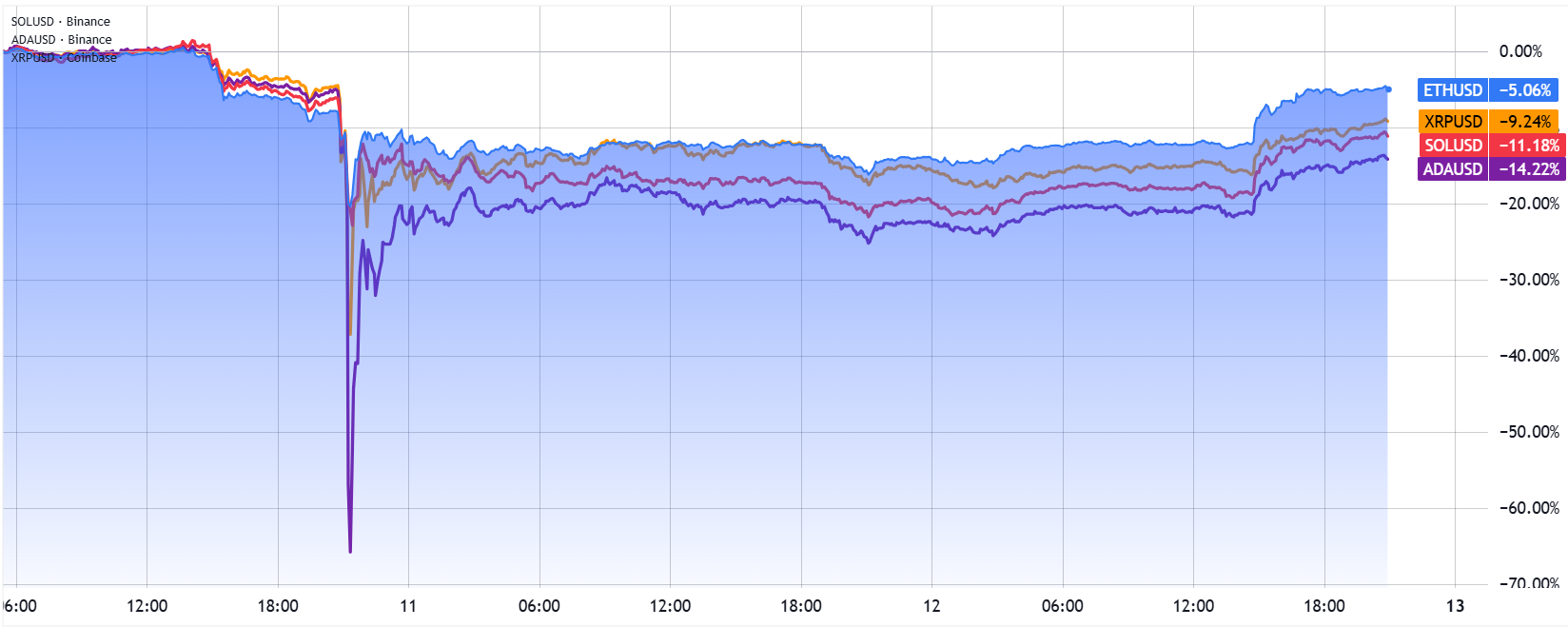

ETH versus other altcoins

ETH versus other altcoins

Notably, several major altcoins encountered corrections hitting far deeper than ETH’s 20.7%, including SUI plummeting by 84%, AVAX by 70%, and ADA by 66%. While Ether’s price dipped by 5% in the last 48 hours, many competitors linger around 10% beneath their pre-crash standings.

Ether’s independence from the broader altcoin developments showcases the backing of its $23.5 billion in spot-backed funds and $15.5 billion in options market open interest. Even with competitors like Solana entering the race for spot ETFs, Ether’s established network and reliability during market volatility continue to position it as the leading choice among institutional investors.

The outlook for Ether remains optimistic with rising confidence in derivative systems, bolstering a pathway towards the $4,500 resistance zone.