Ethereum's Path to $7K by 2026: Analysts Weigh In

Ethereum demonstrates promising support levels as analysts predict a price surge to $7K by 2026, citing bullish trends and significant whale accumulation.

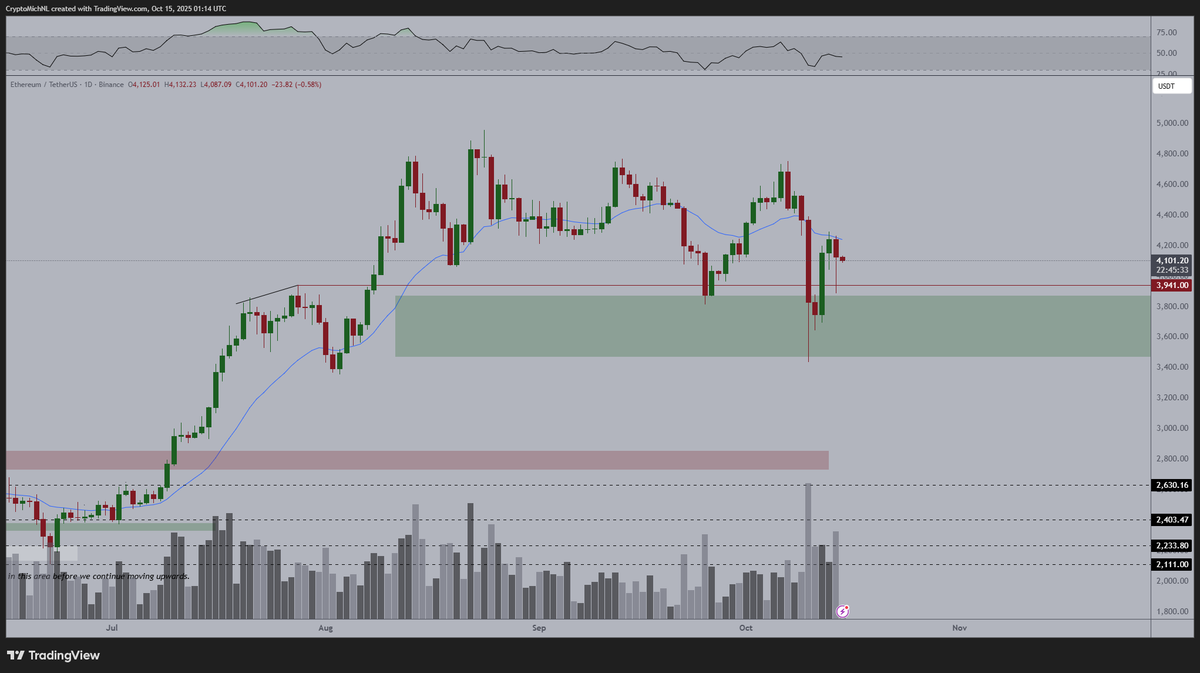

Ethereum is displaying a solid chart structure, with market analysts forecasting a potential price surge to $7,000 by mid-2026. The asset is maintaining key support levels amid a recent price pullback, reflecting a period of consolidation in trading activity.

Bullish Patterns Observed on the Weekly Chart

Technician Mike Investing illustrated that Ethereum is currently in a flag formation on its weekly chart. This setup follows a steady price rise from late 2024 to early 2025, with a recent correction leading it to trade around $4,100 after briefly surpassing $4,400.

"$ETH is positioning within an aggressive bullish flag and is about to see a euphoric squeeze. With $ETH bottomed out and completing its last hard pullback beneath $4k this year this opportunity is generational. Bears are in major trouble now. $7,000 by May 2026." – Mike Investing

According to his analysis, the 200-week moving average, positioned approximately at $2,447, remains an essential support line for maximum retention of its long-term trajectory. Mike suggests a price increase to $7,000, asserting any dip below the $3,500-$3,600 range could jeopardize this bullish formation.

Supply Levels Lowering on Exchanges

Further insights by analyst Michaël van de Poppe indicated a higher low trend in recent price movements, emphasizing the likelihood of a notable breakout in upcoming weeks.

“Higher low is created here on $ETH. I think that we’ll see a strong breakout in the coming 1–2 weeks and a new ATH.” – Michaël van de Poppe

Key Point: The declining supply of Ethereum on exchanges suggests heightened accumulation by wealthy investors, as ongoing trends show lower supply ratios.

Whale Buying Activity Increases

Reports from CryptoQuant analyst Arab Chain reveal that Ethereum supplies on Binance have hit a multi-month low, suggesting increased self-custody among investors. This trend often prefaces price increases in earlier cycles.

“Retail is fading $ETH. Whales are loading up. I’m following the smart money!” – CryptoGoos

This observation underscores a contrasting investment strategy among smaller versus larger investors, revealing a tendency for significant wallet holders to acquire more coins while retail trading volumes dip. Institutional interest in the self-custody and staking of Ethereum continues to rise, contributing to the decreasing liquidity in the market.