BitMine Seizes Opportunity as ETH Prices Dip 20%

BitMine has reportedly accumulated a substantial amount of Ether as prices fall from their August highs, fueling optimism about future gains.

The largest treasury of Ether (ETH), known as BitMine, has made headlines by purchasing an additional 104,336 Ether, valued at around $417 million, as prices drop significantly from their peak in August. This acquisition has augmented BitMine’s holdings to account for over 2.5% of the entire Ether supply.

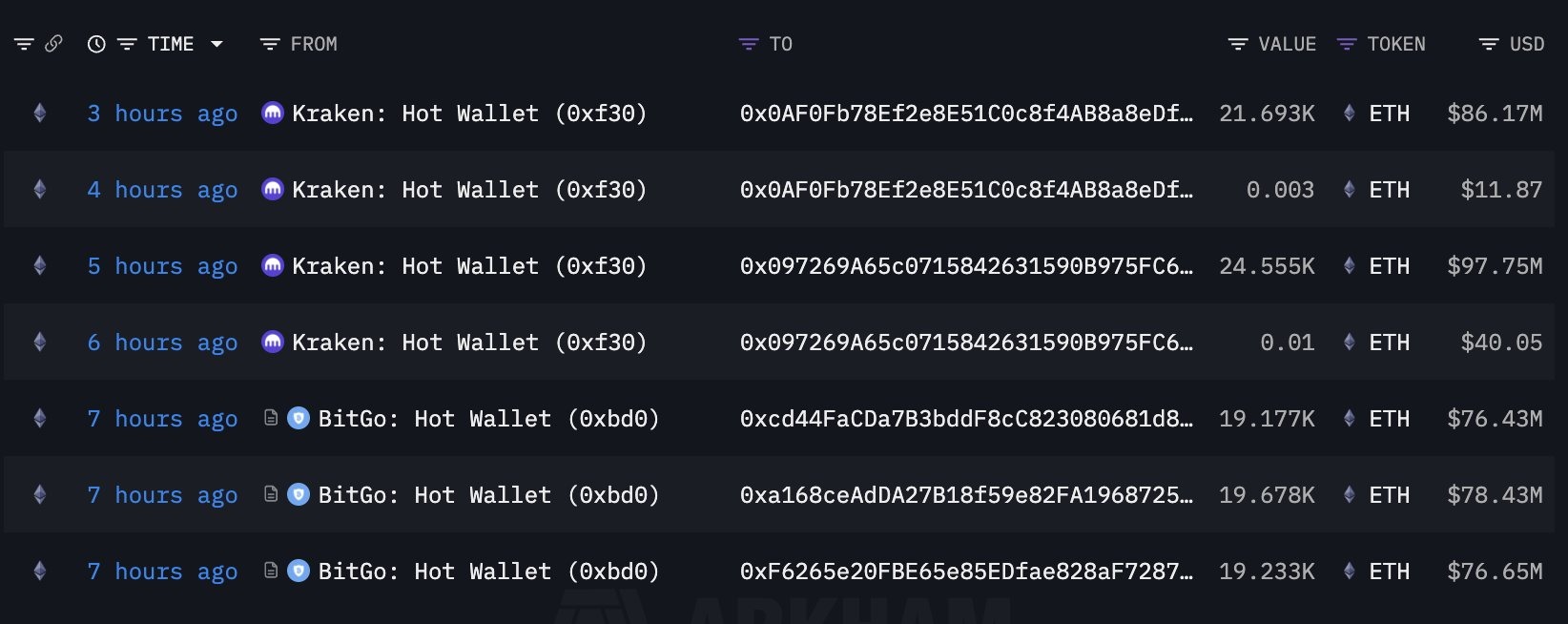

According to on-chain data, three new wallets received these assets from Kraken and BitGo. BitMine has yet to officially verify these transactions.

“Despite the crypto market crash, Tom Lee still predicts ETH will hit $10,000 by year-end,” Lookonchain reported. Translation: Despite the downturn, predictions for ETH remain optimistic.

Earlier this week, Tom Lee and BitMEX co-founder Arthur Hayes reaffirmed their forecasts that Ether could reach $10,000 by the end of this year.

Additionally, Arkham, a blockchain intelligence firm, noted that three new wallets acquired $75 million in Ether each, mirroring the acquisition patterns of BitMine.

Cointelegraph reached out to BitMine for confirmation regarding this purchase but did not receive an immediate reply.

Earlier in the week, BitMine seized on the market’s downturn, announcing they had purchased 202,037 Ether tokens in response to the price drop.

“The recent liquidation in crypto has created a decline in ETH prices, which BitMine capitalized on,” Tom Lee commented previously. Translation: The liquidation events have opened opportunities for strategic acquisitions.

Digital Asset Treasuries Stay Strong

Treasuries such as BitMine seem unfazed by recent market turbulence, instead utilizing the downturn to purchase assets.

Over just a few months, BitMine has achieved 50% of its treasury objective, accumulating approximately 3 million ETH, which amounts to 2.5% of total ETH supply.

Related Articles:

A Continued Downward Trend for ETH

This strategic buying comes as Ether markets experience a downward trend. Recently, ETH was trading at $3,945, marking a 20% decrease from its August peak of $4,946. At the time of writing, it has slightly recovered, hovering just above the psychological price point of $4,000.

Insights from Analysts

While many analysts, including Tom Lee, exhibit a bullish sentiment for Ether’s future, believing it will recover shortly.

“Ethereum seems to be echoing Bitcoin’s growth pattern from 2020 to 2021,” said analyst ‘Rekt Fencer,’ asserting that a price of $15,000 for ETH is feasible this cycle.

Additionally, market analyst ‘Crypto Bullet’ noted similarities in chart patterns between Bitcoin’s trajectory in 2024 and Ether’s in 2025, predicting an upward movement for Ether, potentially reaching between $6,000 and $7,000 this year.

ETH price action comparison with Bitcoin

Source: Crypto Bullet

ETH price action comparison with Bitcoin

Source: Crypto Bullet