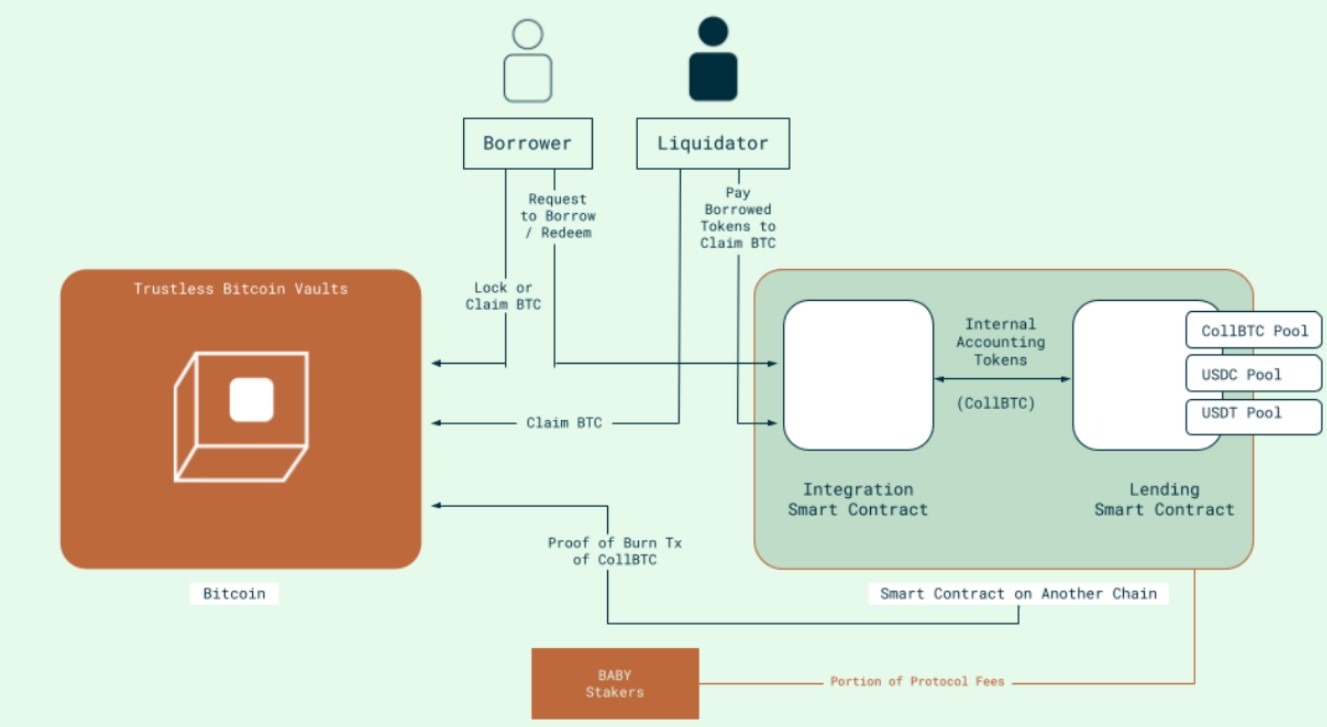

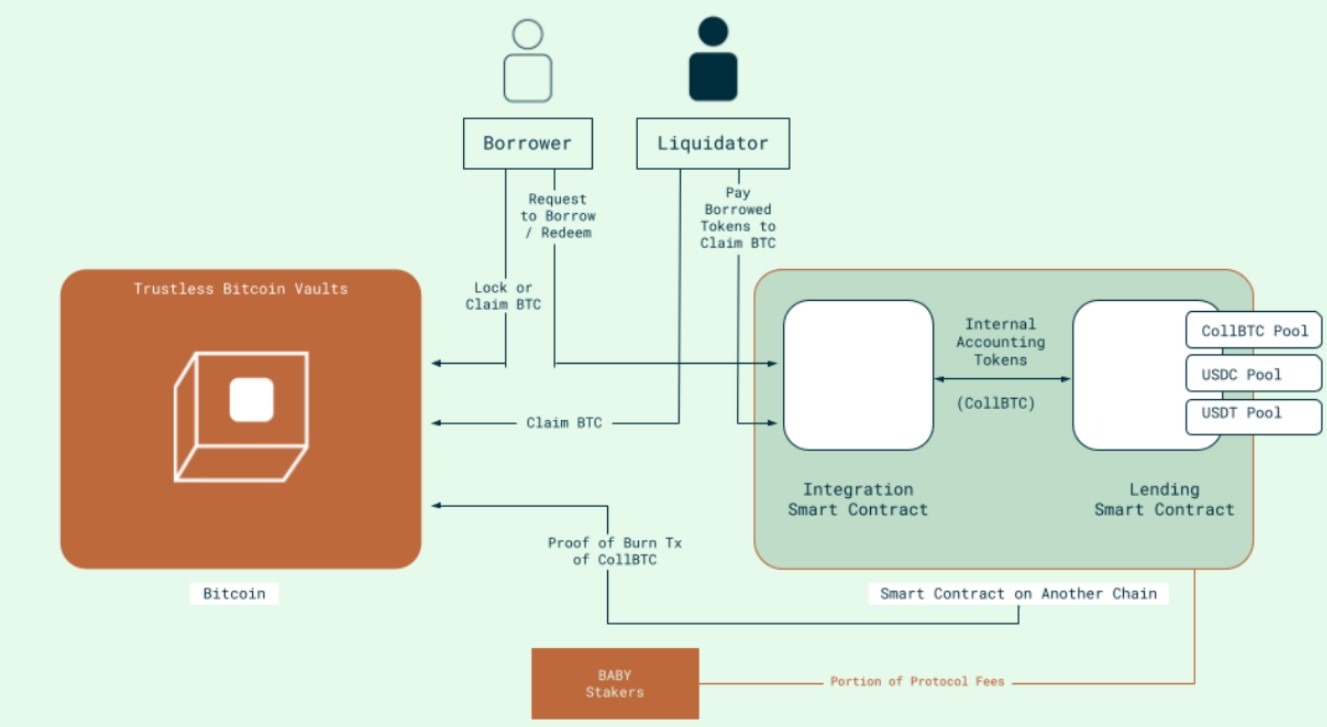

Babylon Labs, a blockchain infrastructure company, has created a proof-of-concept that allows native Bitcoin to be used as collateral for loans in decentralized finance (DeFi). Co-founder David Tse, who is also a Stanford University professor, announced this development on Wednesday, highlighting that it enables users to use Bitcoin “trustlessly” for borrowing on the Ethereum network.

The innovation comes after the company released a white paper detailing a Bitcoin trustless vault system that utilizes the BitVM3 technology for smart contract verification, facilitating the locking of BTC in individual vaults for users. This setup permits the transfer of Bitcoin to Ethereum without the need for custodians or bridges.

A schematic of the Bitcoin vault-based lending system. Source: Babylon Labs

A schematic of the Bitcoin vault-based lending system. Source: Babylon Labs

Related Updates

- BNB Chain Observes Unprecedented User Activity: On Monday, BNB Chain reached a high of 3.46 million active addresses, representing a significant increase in transactions up by 151% over the previous month.

Addresses that sent a transaction on BNB Chain. Source: Nansen

Addresses that sent a transaction on BNB Chain. Source: Nansen

- Hyperliquid Updates: The decentralized exchange Hyperliquid has now enabled third parties to launch their perpetual futures contracts through a new update approved under Hyperliquid Improvement Proposal 3 (HIP-3).

Discord message announcing the upgrade. Source: Hyperliquid

Discord message announcing the upgrade. Source: Hyperliquid

- Uniswap Integrates Solana Support: Uniswap’s recent support for Solana allows users from that network to trade Solana-based tokens alongside others, significantly increasing potential market opportunities.

Source: Uniswap Labs

Source: Uniswap Labs

Overview of the DeFi Market

Most of the top 100 cryptocurrencies by market cap ended the week negatively, with notable gains in BNB Attestation Service (BAS), which soared by 456% last week. More insights to come as the DeFi landscape continues to evolve.