Ethereum Price Forecast: Key Levels for Bullish Movements This Week

Ethereum is currently experiencing a consolidation phase with significant support and resistance levels to watch for potential bullish trends.

Ethereum is currently in a consolidation phase between key institutional levels, with support set at $3,400 and resistance at $4,600. The symmetrical triangle formation noted suggests a potential breakout in either direction.

Technical Analysis

Daily Chart

The daily chart shows Ethereum (ETH) stuck within a range defined by the $3.4K support and the $4.6K resistance. A recent rejection from $4.2K coincided with a retest of a previously broken ascending trendline and the 100-day moving average, marking both as resistance points.

Momentum appears to be slowing, with ETH hovering below the 100-day MA and near the mid-range of its larger price band. The 200-day MA around $3.1K provides final dynamic support, while the $3.4K demand zone continues to attract buying interest.

For ETH to regain bullish momentum, it must decisively close above $4.2K, setting the stage for a movement towards the $4.6K resistance level.

Daily ETH Chart

Daily ETH Chart

Source: TradingView

4-Hour Chart

The 4-hour timeframe reflects a symmetrical triangle pattern, indicating market indecision post the recent sell-off. The structure’s upper boundary sits at $4K resistance, while the lower boundary is supported by the $3.8K short-term range floor.

This structure suggests a liquidity compression phase as volatility narrows ahead of a potential breakout. A breach above the upper trendline could prompt a rally toward $4.4K–$4.6K, while a drop below $3.7K may lead back to the $3.4K demand zone.

4-Hour ETH Chart

4-Hour ETH Chart

Source: TradingView

Sentiment Analysis

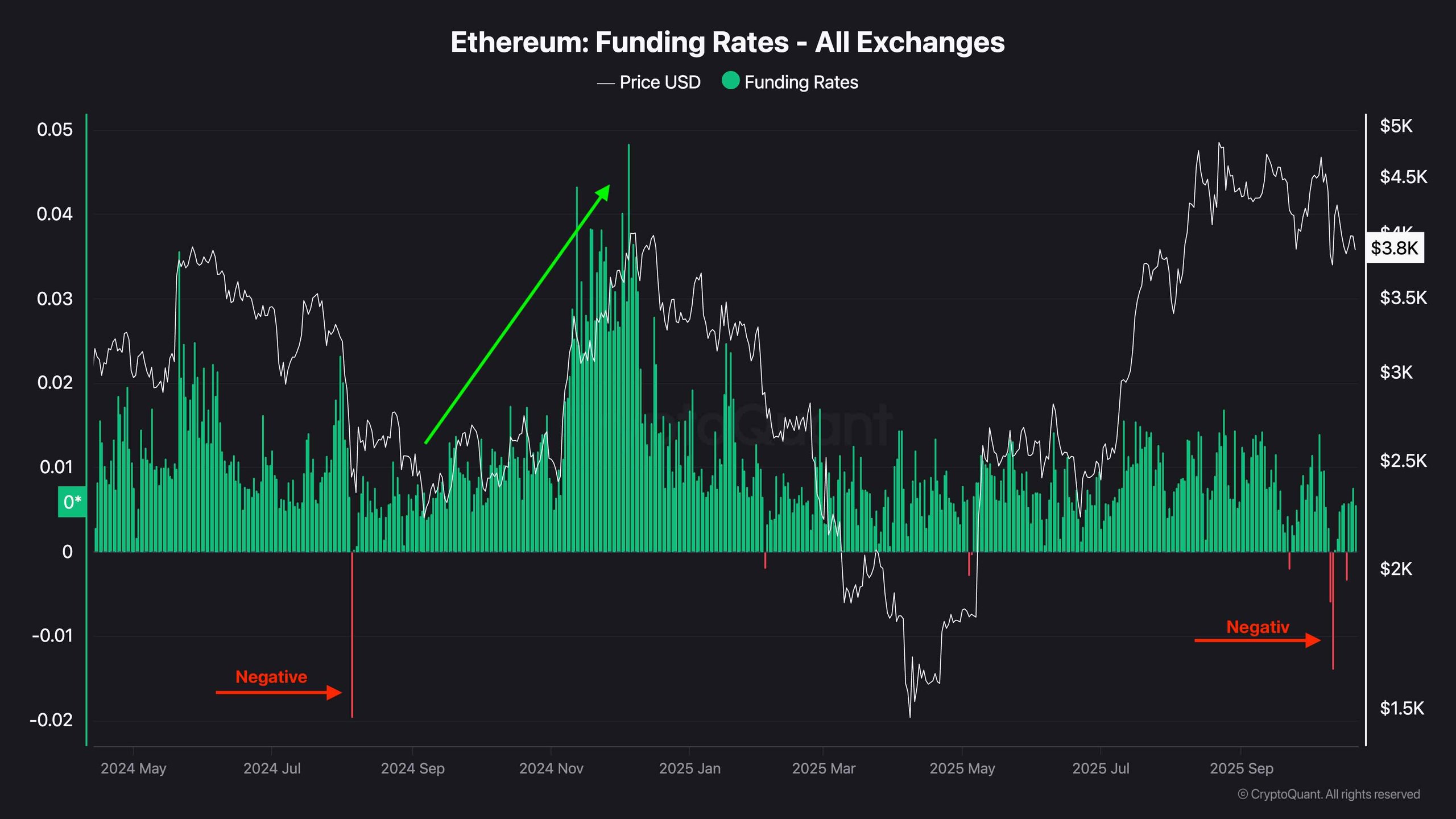

Ethereum’s funding rates across all exchanges have turned negative, mirroring sentiments seen during significant market bottoms in prior cycles. Historically, such negative readings often precede sharp bullish reversals once selling pressure exhausts itself.

Currently, the negative sentiment hints at fear-driven shorting pressure, which can fuel upward momentum if the support around $3.8K–$3.4K holds.

Funding Rates

Funding Rates

Source: CryptoQuant