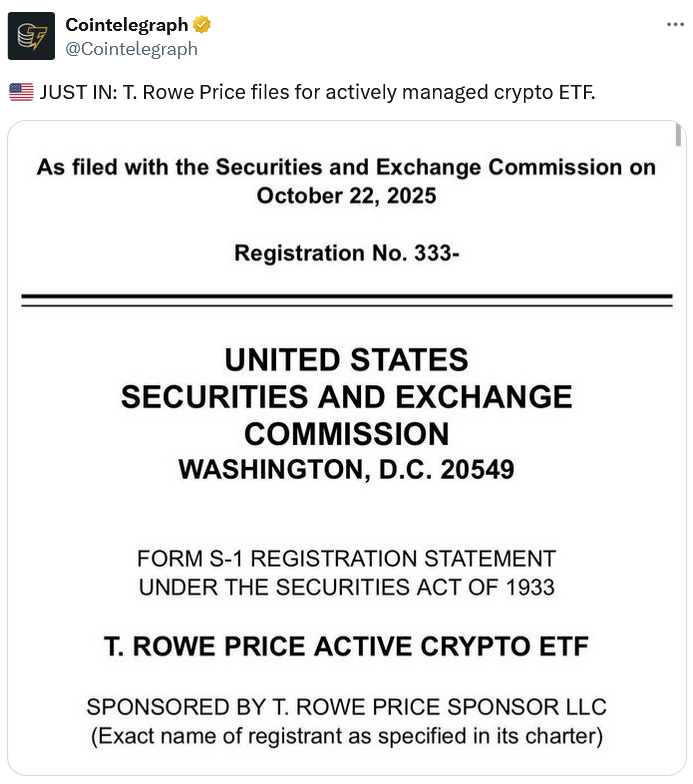

T. Rowe Price, managing assets worth $1.8 trillion, has taken an unexpected step into the crypto realm by filing for a US-listed Active Crypto ETF, a move that caught some analysts off guard.

The S-1 registration to launch the ETF could disrupt T. Rowe Price’s traditional focus on mutual funds, a sector that has seen significant outflows recently.

The filing, sent to the Securities and Exchange Commission (SEC), indicates the fund will likely include between 5 to 15 cryptocurrencies, among which Bitcoin (BTC), Ether (ETH), Solana (SOL), and XRP are included as per the SEC’s listing standards.

T. Rowe Price Crypto ETF

Source: Cointelegraph

T. Rowe Price Crypto ETF

Source: Cointelegraph

Nate Geraci, President of NovaDius Wealth Management, characterized the filing as out of the ordinary, suggesting that traditional asset managers like T. Rowe are now scrabbling to identify their place in the crypto ETF landscape.

In a similar vein, Bloomberg’s Eric Balchunas labeled the move a “SEMI-SHOCK,” highlighting that T. Rowe Price has traditionally emphasized mutual fund investments throughout its 87 years.

“Did not expect it but I get it. There’s gonna be land rush for this space too.”

The ETF’s objective focuses on outperforming the FTSE Crypto US Listed Index, using an asset weighting based on fundamentals, valuations, and momentum.

In addition to the previously mentioned cryptocurrencies, T. Rowe’s fund could also consider Cardano (ADA), Avalanche (AVAX), Litecoin (LTC), Dogecoin (DOGE), Hedera (HBAR), Bitcoin Cash (BCH), Chainlink (LINK), Stellar (XLM), and Shiba Inu (SHIB).

T. Rowe’s Active Crypto ETF differs from many single-coin ETF applications pending SEC approval due to various government shutdowns delaying the process, including those for LTC, SOL, and XRP.

Kevin Hassett, an adviser to President Trump, noted that the government shutdown is expected to come to an end soon.

In the past, William Stromberg, T. Rowe’s former CEO, remarked that crypto was still in its ’early days’ and anticipated significant developments in due course.

For more in-depth insights, see this related article about Hong Kong’s first spot Solana ETF.