Bitcoin Price Analysis: BTC Faces Key Support Amid Uncertainty

Bitcoin attempts recovery while market sentiment remains cautious as it holds critical support levels.

Bitcoin is making attempts to rebound following a significant correction last week, yet the market remains at a crucial decision point. While the price shows signs of recovery, general sentiment leans towards caution. The pivotal query now is whether this resurgence signifies an actual reversal or merely a temporary relief prior to a further decline.

Technical Analysis

The Daily Chart

On the daily chart, BTC rebounded after finding support at the 200-day moving average around $108K, a level that has demonstrated strong demand in past corrections. This was also a foundational area for the bullish movements seen in September and early October.

Nevertheless, Bitcoin has yet to surpass the dotted midline of the channel or the 100-day moving average, both situated around the $115K region. Buyers cannot reassert control until there is a daily close above these two resistance levels.

BTC Daily Chart

BTC Daily Chart

The 4-Hour Chart

In a 4-hour perspective, BTC is testing a descending trendline from recent highs while hovering near the $111K mark. For a definitive shift in short-term momentum, a closing above the $112K area is needed. The RSI is moving towards 60, indicating increasing bullish pressure but without being overstretched. If the trendline breaks upward, the target could be the $116K resistance zone soon; otherwise, a failed breakout might lead to a deeper decline toward the critical $100K demand area.

BTC 4H Chart

BTC 4H Chart

Sentiment Analysis

Open Interest

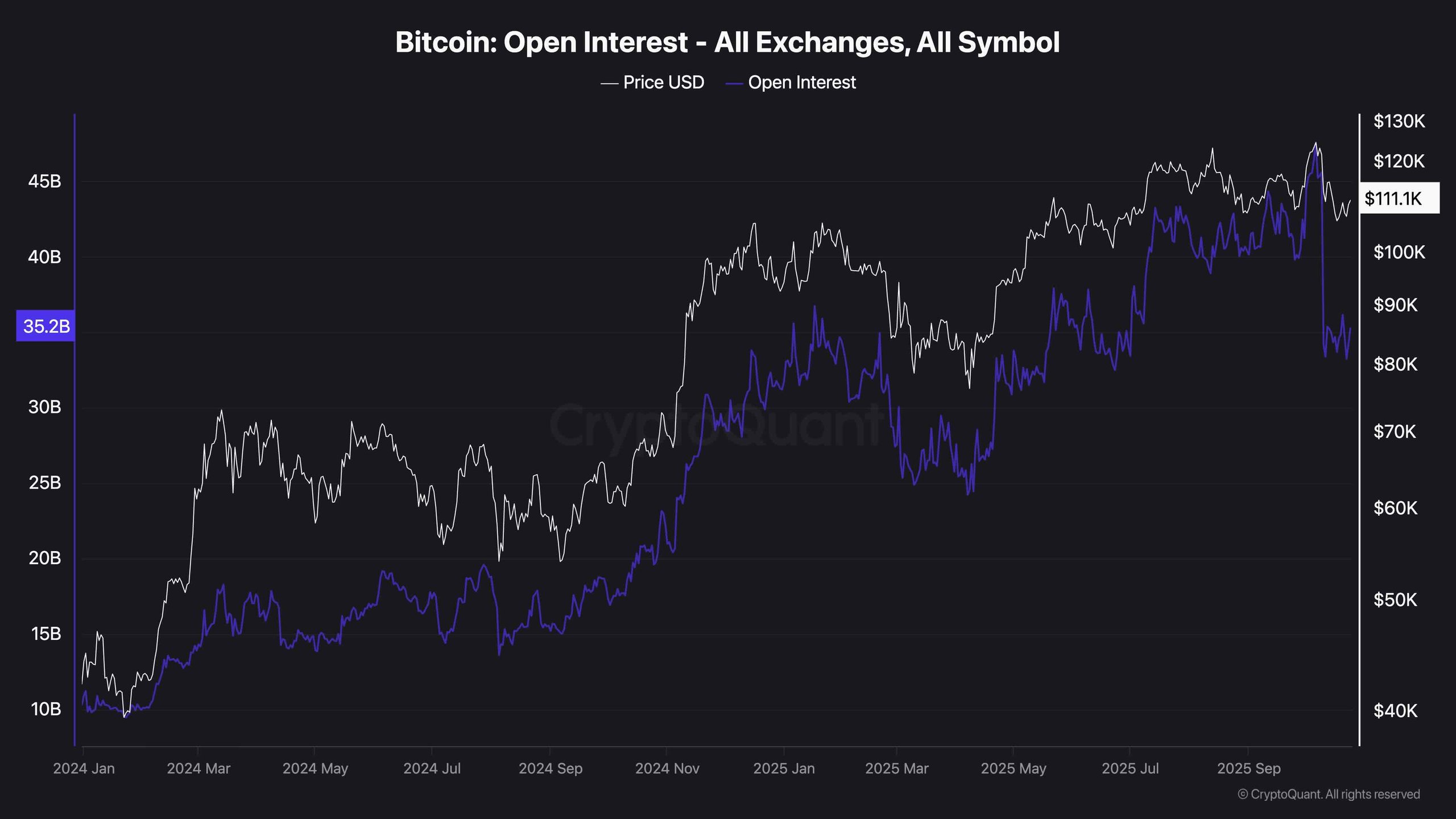

Analyzing the sentiment in the futures market reveals that open interest is stabilizing around $35 billion after a sharp drop, suggesting that while some traders are cautiously re-entering leveraged positions, overall market sentiment still lacks stability. Higher open interest relative to recent historical levels indicates a risk of cascading liquidations should the market break below previously mentioned resistance levels. A failure to reclaim $115K would likely prompt a new wave of liquidations, especially as the weekend approaches.

Futures Market Open Interest

Futures Market Open Interest

Disclaimer: The information presented in this article is sourced from the authors mentioned. It does not reflect the opinions of CryptoPotato regarding the decision to buy, sell or hold any investments. Always conduct your research before making investment moves.