Corporate crypto treasuries have managed to siphon off around $800 billion from retail investors, significantly disadvantaging the altcoin market, per insights from 10x Research.

Even with rising expectations for an impending altcoin season, the industry is witnessing increased capital returning to Bitcoin and corporate digital asset treasuries. This phenomenon has raised questions about the traditional cycles of the crypto market.

Bitcoin vs altcoin tactical model. Source: 10xresearch.com

Bitcoin vs altcoin tactical model. Source: 10xresearch.com

Despite many hoping for an altcoin rally, 10x Research indicates that liquidity and momentum seem to have shifted away, rendering the altcoins market relatively inactive. Their Friday blog states:

“Liquidity, momentum, and conviction have all migrated elsewhere, leaving the altcoin market eerily quiet.”

10x Research also mentioned:

“Altcoins have underperformed Bitcoin by approximately $800 billion this cycle — a gap that would have benefited retail investors.”

As a result, the report suggests that many retail investors are now exploring alternative investment opportunities for better returns.

Key Indicators Suggest a Shift Back to Bitcoin

Recent signals indicate that investors are seeking to increase their exposure to Bitcoin rather than smaller cryptocurrencies, despite persistent calls for an altcoin season.

The so-called “technical altcoin model” emphasized by 10x Research has indicated that funds are rotating back towards Bitcoin, implying that a $19 billion market crash has disrupted the altcoins’ earlier performance.

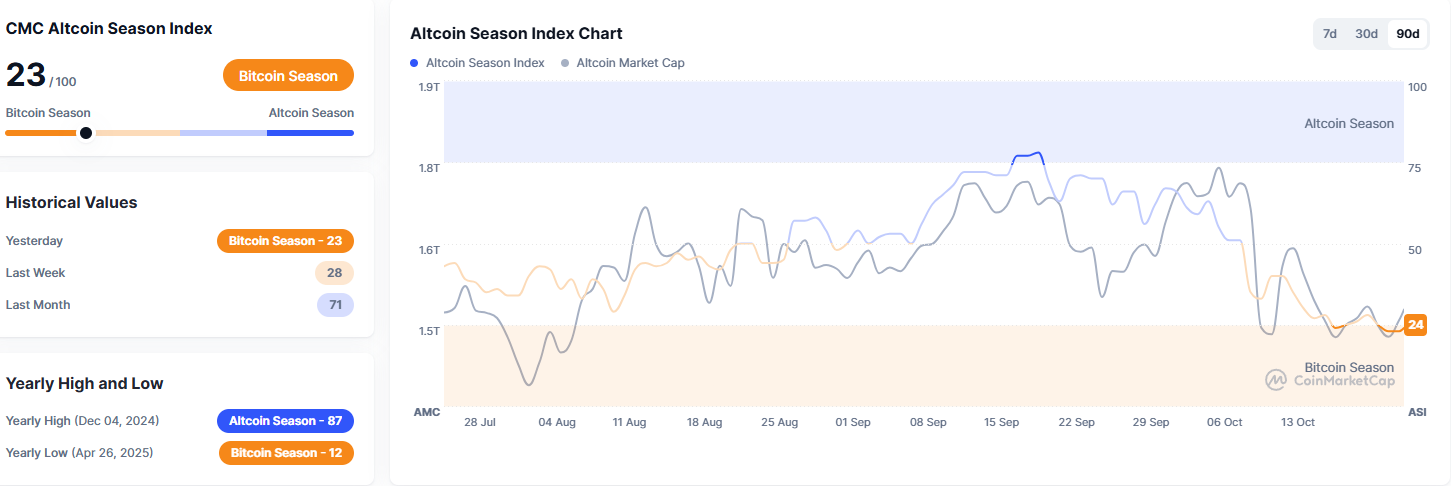

Altcoin season index chart. Source: CoinMarketCap

Altcoin season index chart. Source: CoinMarketCap

CoinMarketCap’s altcoin season indicator is currently at 23, which suggests a Bitcoin season unless it exceeds the 75-level threshold.

While some are hoping that this recent market correction could serve as a buying chance, Geoff Kendrick of Standard Chartered believes that it could help propel Bitcoin towards the $200,000 mark by year’s end.