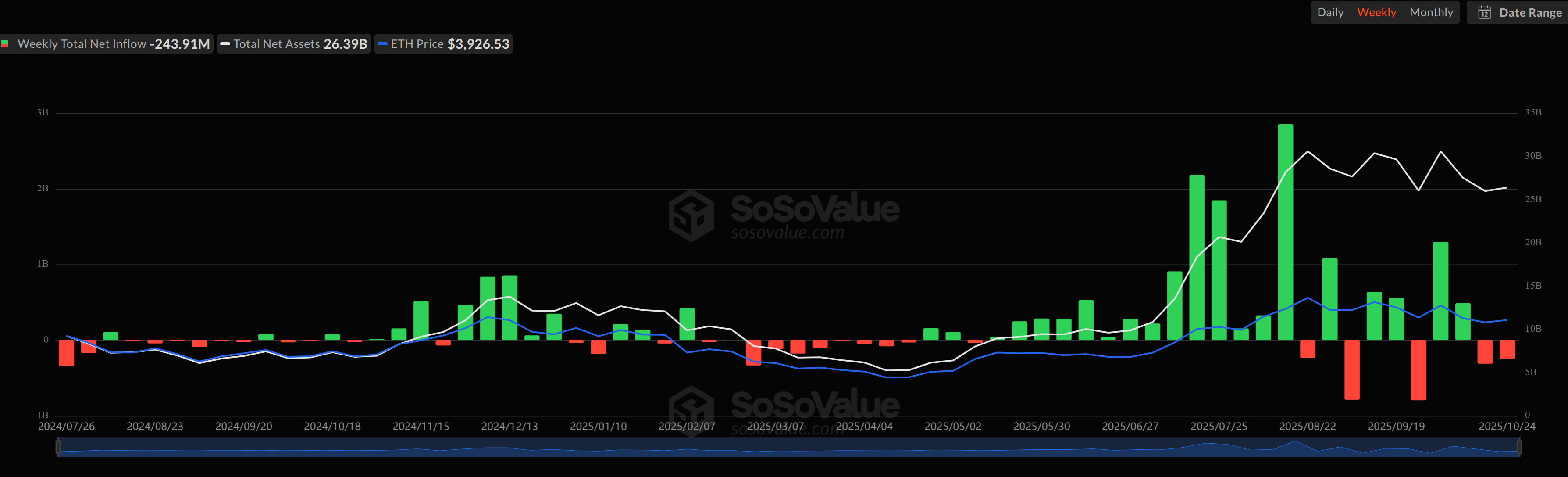

Spot Ethereum exchange-traded funds (ETFs) have recorded outflows for the second week in a row, suggesting diminishing demand from investors following a period of strong inflows.

According to data from SoSoValue, Ether (ETH) products registered net redemptions of $243.9 million for the week ending Friday, following the previous week’s $311 million outflow. This latest data brings cumulative inflows across all Ether spot ETFs to $14.35 billion, with total net assets standing at $26.39 billion, constituting approximately 5.55% of Ethereum’s market capitalization.

On that Friday alone, the funds experienced $93.6 million in outflows. BlackRock’s ETHA ETF was the largest contributor to these outflows with $100.99 million, while Grayscale’s ETHE and Bitwise’s ETHW experienced minimal inflows.

Ether funds see outflows for second week. Source: SoSoValue

Ether funds see outflows for second week. Source: SoSoValue

Related: Bitcoin ETF apathy is pressuring a key Bitcoin support level

Bitcoin ETFs See Renewed Strength

In contrast, Bitcoin (BTC) ETFs have seen a resurgence this week, attracting $446 million in net inflows as institutional investors re-enter the market, per SoSoValue data. On Friday, these products added another $90.6 million, pushing cumulative inflows to $61.98 billion and total net assets to $149.96 billion, representing 6.78% of Bitcoin’s market capitalization.

BlackRock’s iShares Bitcoin Trust (IBIT) led the way with $32.68 million, followed closely by Fidelity’s FBTC, which added $57.92 million. Both funds remain dominant in assets, with IBIT holding $89.17 billion and FBTC at $22.84 billion.

Bitcoin funds see inflows. Source: SoSoValue

Bitcoin funds see inflows. Source: SoSoValue

Related: Bitcoin ETFs Add $2.7B in ‘Uptober’ Despite Tariff Fears

Comparison between Bitcoin and Ethereum ETFs

Vincent Liu, chief investment officer at Kronos Research, remarked that these ETF flows reflect a robust transition towards Bitcoin, as it is seen as “digital gold” and a reliable store of value. Liu noted that the revived interest in Bitcoin showcases broader market trends favoring resilient assets amidst global uncertainty and expectations of forthcoming interest rate reductions.

Conversely, Ethereum’s consecutive outflows highlight dwindling interest and lowered on-chain activity, with institutional investors biding their time for new opportunities before re-engaging.

Looking forward, Liu anticipates continued strength in Bitcoin inflows while traders prepare for a potential economic boost from monetary easing. He expressed that Ethereum and other altcoins could only rebound if network activity improves or new incentives arise.

Magazine: Back to Ethereum — How Synthetix, Ronin and Celo saw the light