Citi to Explore Stablecoin Payments in Collaboration with Coinbase

Citi announces a partnership with Coinbase to trial stablecoin payments, signaling a shift towards digital currencies and predicting a $4 trillion market by 2030.

Citigroup may soon lead Wall Street by offering stablecoin payment services, which could represent a critical step towards broader acceptance of digital dollars after the implementation of the GENIUS Act this year.

According to Bloomberg, Citi is collaborating with cryptocurrency exchange Coinbase to enhance its digital asset services, primarily enabling clients to transfer funds between fiat currency and cryptocurrency.

Debopama Sen, Citi’s payments head, indicated that their clients are increasingly requesting programmable options, conditional payments, and enhanced speed and accessibility around the clock.

Sen stated, “Stablecoins will serve as another facilitator in the digital payment landscape, fostering growth in this sector and improving client capabilities.”

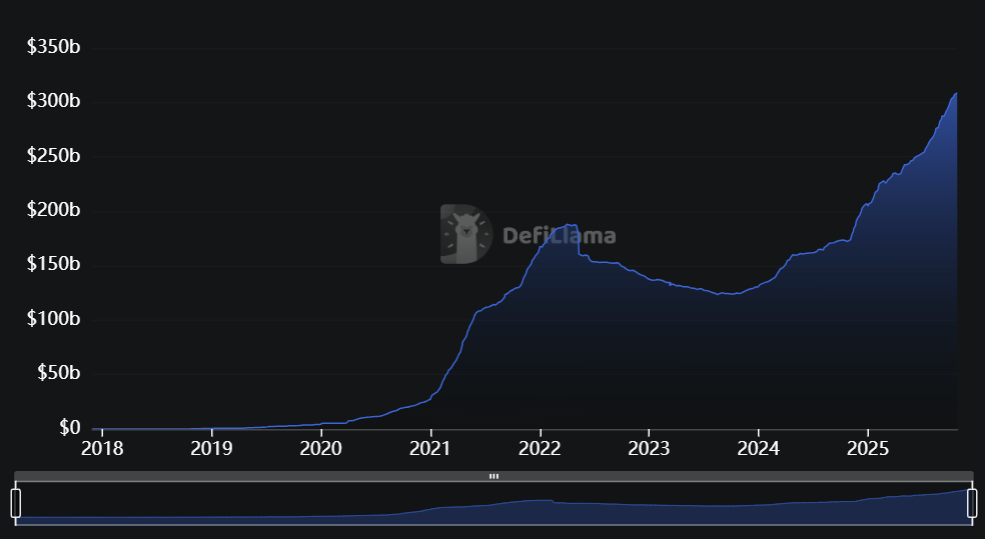

Citi’s focus on stablecoins aligns with its updated prediction of a $4 trillion market for digital dollars by 2030, a substantial increase from the $315 billion valued today.

Market Growth

The stablecoin market has expanded from under $5 billion in early 2020 to more than $315 billion today. Source: DefiLlama

Market Growth

The stablecoin market has expanded from under $5 billion in early 2020 to more than $315 billion today. Source: DefiLlama

Wall Street’s Interest in Stablecoins

With the recent adoption of the US GENIUS Act, which establishes a framework for stablecoins and is set to take effect in early 2027, major banks are eager to develop their own stablecoin strategies.

Citigroup joins a growing cohort of institutions, including JPMorgan and Bank of America, who are beginning to explore options related to stablecoin services. Notably, JPMorgan’s CEO Jamie Dimon has indicated that the bank intends to engage in developing stablecoin solutions.

Investor interest is rising alongside the engagement from institutions. Circle, the issuer of USDC (the second-largest dollar-pegged stablecoin) went public this year, making headlines with a 167% surge on its first trading day.

Related: Tokenized money market funds emerge as Wall Street’s answer to stablecoins