Ethereum Price Analysis: Are the Bulls Strong Enough to Maintain $4K?

Analyzing Ethereum's price movements, its resistance levels, and the market's current sentiment regarding potential future price actions.

Ethereum begins the week trading near the $4,000 mark following a rejection at the upper boundary of its descending channel. Although buyers have shown some strength, the overall trend remains bearish.

Technical Analysis

By Shayan

Daily Chart

Currently, ETH is positioned just beneath the 100-day moving average, which serves as a temporary resistance level. The Relative Strength Index (RSI) is at around 47, indicating a neutral market without a strong directional trend.

A move above $4,200 could trigger a retest of the significant supply zone around $4,600. However, failing to surpass this resistance might indicate more downward movement. The critical support zone of $3,500 must hold, as a drop below it could lead to a retracement toward $3,000, along with crossing under the vital 200-day moving average, which could have severe repercussions for ETH.

Ethereum Daily Chart

Source: TradingView

Ethereum Daily Chart

Source: TradingView

4-Hour Chart

The 4-hour chart showcases a rejection at the $4,200 resistance, coinciding with a previous supply area. The recent pullback revealed temporary buyer interest within the fair value gap around $4,000. Nonetheless, the RSI is declining from overbought levels, indicating a softening of short-term bullish momentum.

To sustain purchaser control, reclaiming the recent highs is essential. Otherwise, another decline towards the lower boundary at approximately $3,600 is likely in the near sessions.

Ethereum 4-Hour Chart

Source: TradingView

Ethereum 4-Hour Chart

Source: TradingView

On-Chain Analysis

Exchange Reserve

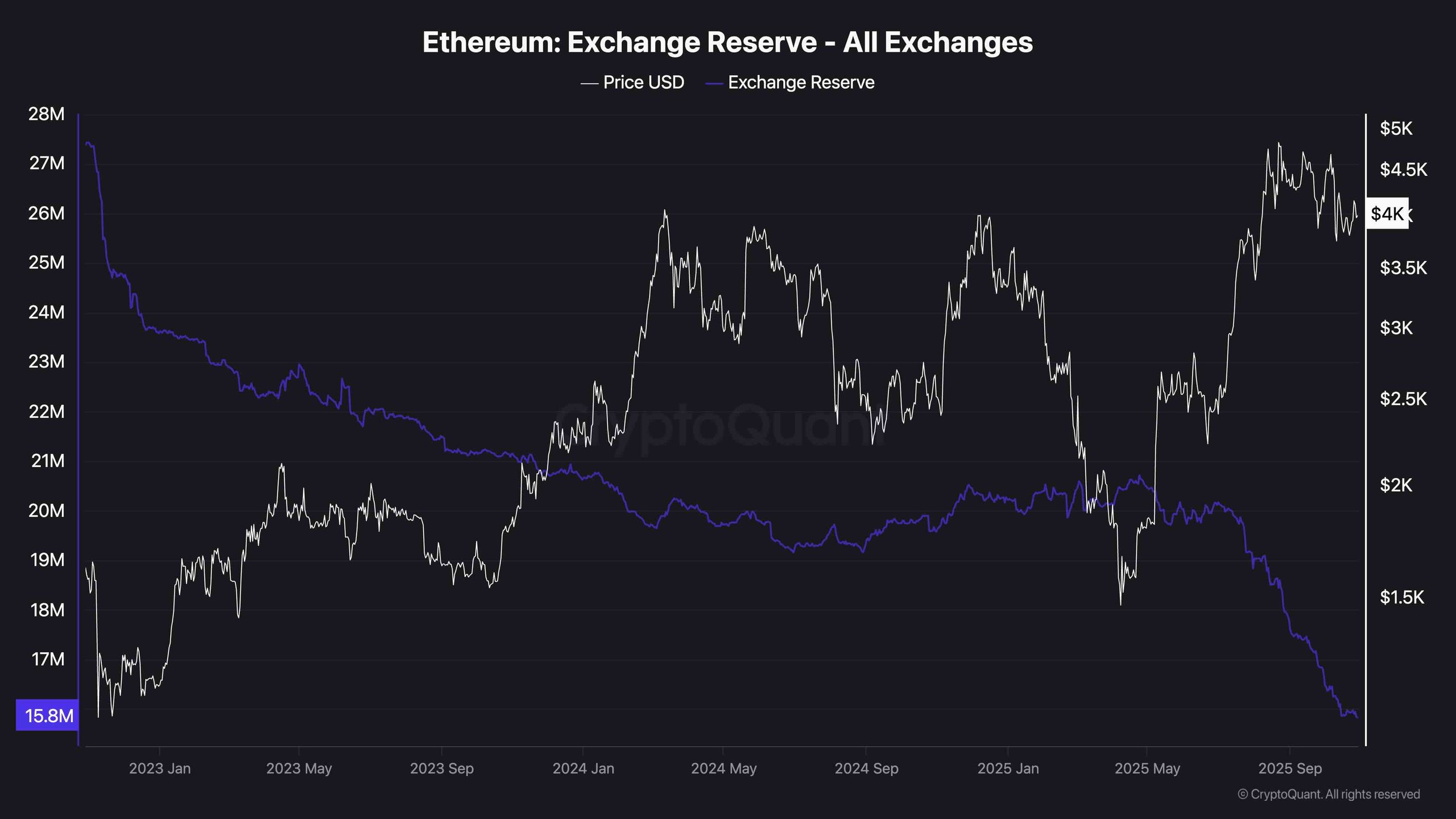

The on-chain sentiment remains favorable as Ethereum’s exchange reserves continue their decline, currently down to 15.8 million ETH—its lowest in several years. This trend suggests diminished selling pressure from spot holders, marking it as a long-term bullish indicator. However, futures market metrics show neutrality, with no excessive leverage evident, pointing toward a need for new catalysts to stimulate a market breakout. Until such catalysts emerge, ETH is likely entrenched in a consolidation phase characterized by a larger corrective trend.

Ethereum On-Chain Analysis

Source: CryptoQuant

Ethereum On-Chain Analysis

Source: CryptoQuant

Important Note

The content presented here is for informational purposes only and does not constitute financial advice. Please conduct your own research before making any investment decisions.