BitGo, a digital asset infrastructure firm, has expanded its services to include custody support for Canton Coin (CC), the native token of the Canton Network. This enhancement is designed to simplify how regulated institutions in the United States securely hold the asset.

The collaboration was announced on Wednesday, emphasizing it will allow banks and asset managers to access a network that is already managing a significant amount of tokenized real-world assets (RWAs).

This partnership introduces cold-storage custody and provides insurance-backed security, which could offer the groundwork for future support of stablecoins, tokenized securities, and other on-chain financial products.

“This integration signifies a crucial move towards institutional adoption of CC and supports the broader Canton ecosystem,” noted Melvis Langyintuo, the Executive Director of the Canton Foundation, which supervises the network’s governance and ecosystem growth.

The Canton Network aims to bring regulated institutions on-chain, fostering interoperability among financial applications and tokenized assets while ensuring compliance. Its backer, Digital Asset, recently raised $135 million from notable investors such as Goldman Sachs, Citadel Securities, BNP Paribas, and the Depository Trust & Clearing Corporation (DTCC).

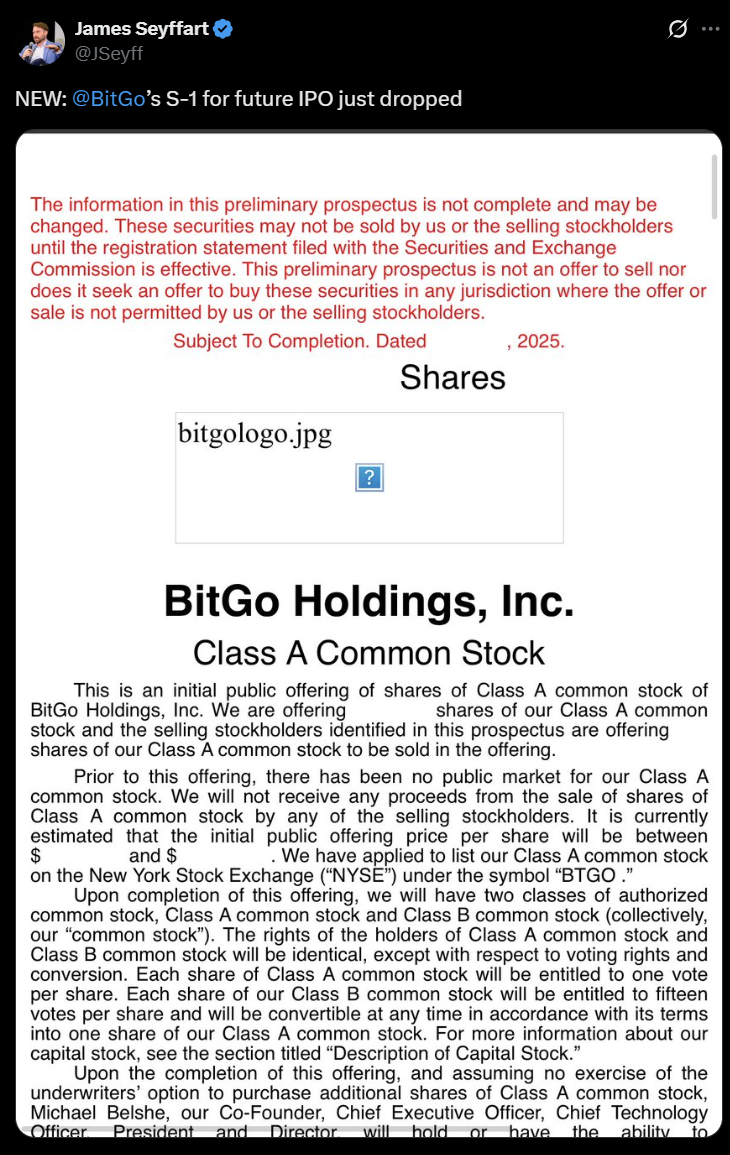

As one of the largest custodians in the cryptocurrency space, BitGo handles approximately $90 billion in assets under custody and is expanding its institutional services in response to increasing demand for regulated digital asset infrastructure. Recently, BitGo has filed for an initial public offering in the United States.

Image

Source: James Seyyfart

Image

Source: James Seyyfart

Growth in Institutional Participation in the Canton Network

Since its debut in 2023, the Canton Network has experienced heightened activity, as evidenced by P2P.org — a staking infrastructure provider managing over $10 billion in assets — recently joining its ecosystem along with major players like Goldman Sachs, JPMorgan, Bank of America, and Citigroup.

Two leading global banks, BNP Paribas and HSBC, have also aligned with the Canton Foundation to promote its mission and advance blockchain technology catered to institutional requirements.

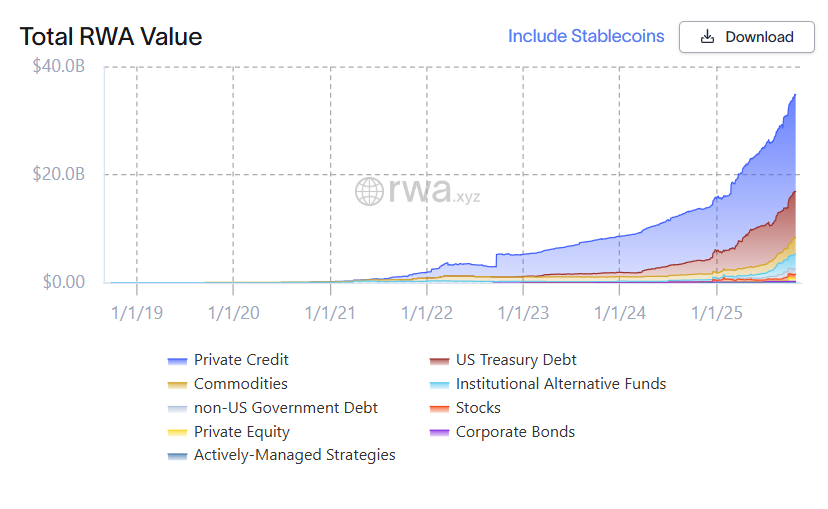

This growth coincides with a surge in institutional interest surrounding RWAs, a core element of Canton’s strategy. Industry insights reveal that the total market value of tokenized RWAs, excluding stablecoins, has exceeded $35 billion, encompassing various use cases from private credit to US Treasury bonds, private equity, and equities.

Image

Total RWA market value, excluding stablecoins. Source: RWA.xyz

Image

Total RWA market value, excluding stablecoins. Source: RWA.xyz

Related: Canton Network taps Chainlink as super validator, integrates oracles and CCIP

Magazine: Ethereum is destroying the competition in the $16.1T TradFi tokenization race