Ethereum Whales Accumulate ETH as Exchange Reserves Dwindle

Accumulating Ethereum indicates potential price movements as reserves decline significantly.

Ethereum (ETH) currently trades around $4,000, following a bounce from $3,900 this week. While there’s been a 4% increase in the past week, a slight 3% decline was noted in the last 24 hours. Currently, ETH remains approximately 19% below its all-time high of $4,950, as indicated by CoinGecko.

Recent data from Alphractal shows a notable rise in Ethereum addresses holding over 1,000 ETH, drawing significant attention.

ETH Leaves Exchanges as Supply Shrinks

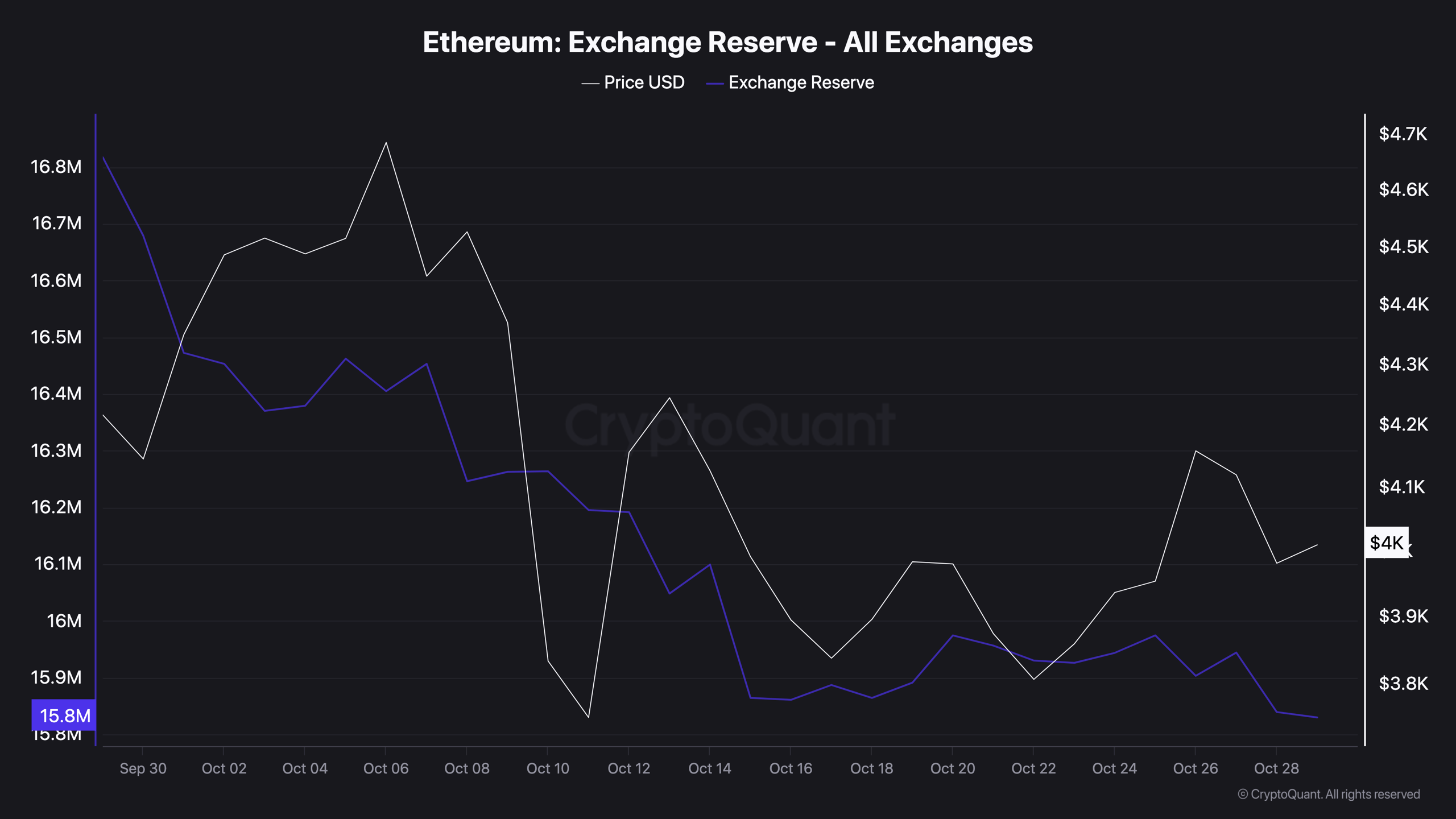

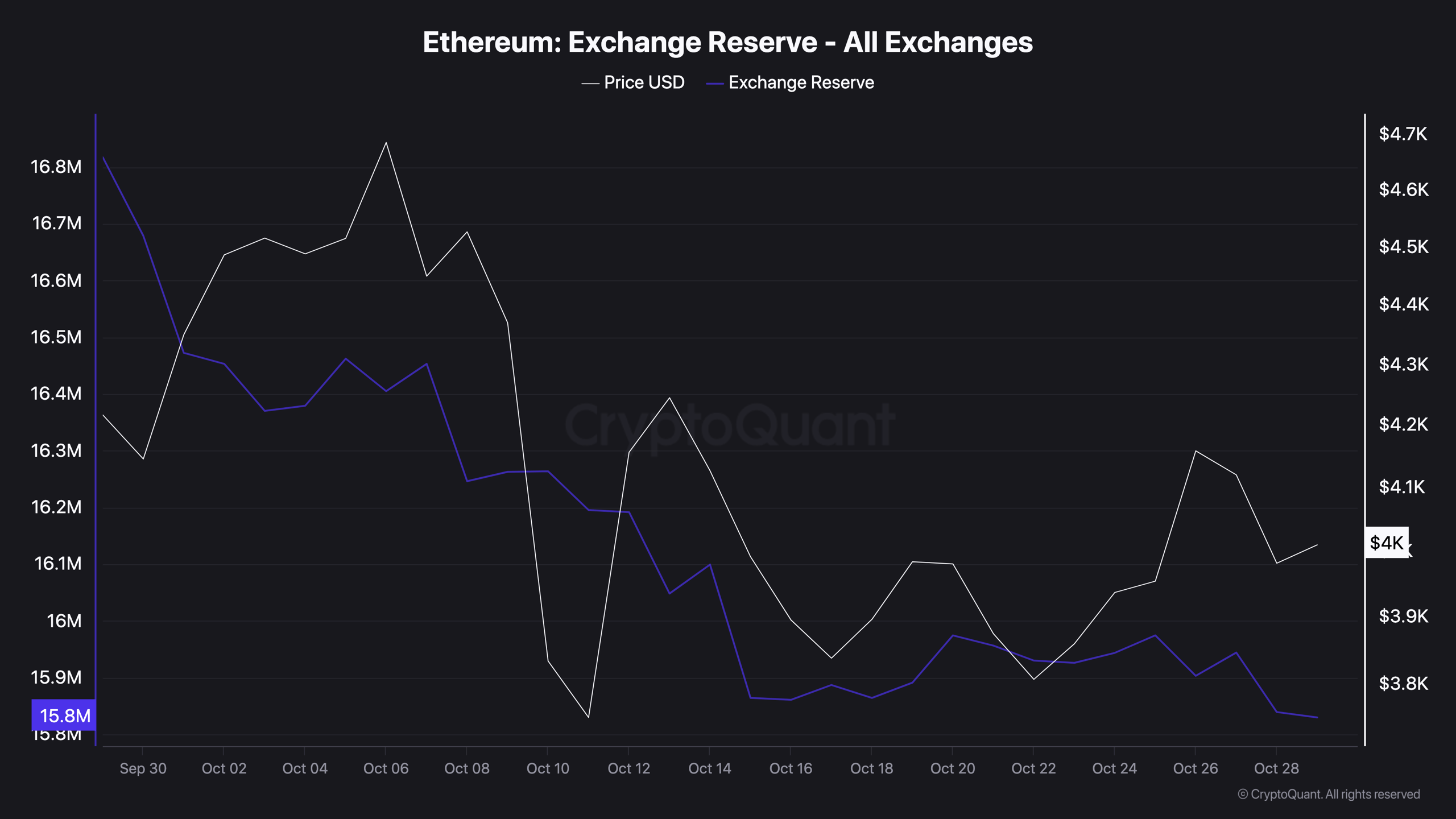

Supporting this trend, data from CryptoQuant reveals a decline in ETH reserves across exchanges, with about 1 million ETH withdrawn since late September, falling from 16.8 million to 15.8 million. This steady outflow, suggesting a shift towards self-custody, often indicates long-term holding, coincides with ETH maintaining its price above $4,000.

Ethereum Exchange Reserve

Source: CryptoQuant

Ethereum Exchange Reserve

Source: CryptoQuant

Bigger Players Increase Exposure

Institutional interest in Ethereum has surged, with reports indicating that ETH holdings by institutions are growing nearly four times quicker than Bitcoin’s in the last year. Notably, Bitmine, backed by Tom Lee, purchased 27,316 ETH valued over $113 million, now holding 3.34 million ETH worth approximately $13.3 billion. Lee projected that ETH could hit $15,000 by December, although such forecasts remain speculative.

Key Levels Hold as Market Waits

Ethereum’s trading range oscillates between $4,000 and $4,150. A similar pattern was observed in mid-2025 when ETH traded sideways before escalating from $2,500 to $3,800, with some analysts perceiving the current setup as a potential base.

In closing, BitBull points out that “as long as the $3.8K–$4K zone holds, there’s no reason to be bearish on Ethereum”. Furthermore, short-term price actions are sensitive, as another analyst suggests that ETH’s drop to $3,900 may be linked to risk mitigation ahead of the FOMC meeting.