Shares in MicroStrategy surged nearly 6% in after-hours trading following the announcement of a net income of $2.8 billion for the third quarter. This is a decline from the previous quarter’s record of $10 billion but still surpasses analyst predictions.

On Thursday, MicroStrategy revealed that diluted earnings per share stood at $8.42 for the period ending September 30, which outperformed Wall Street’s forecast of $8.15. The $2.8 billion income marks a significant improvement from the loss of $340.2 million recorded during the same time last year, although it is lower than the unprecedented $10 billion profit reported in Q2.

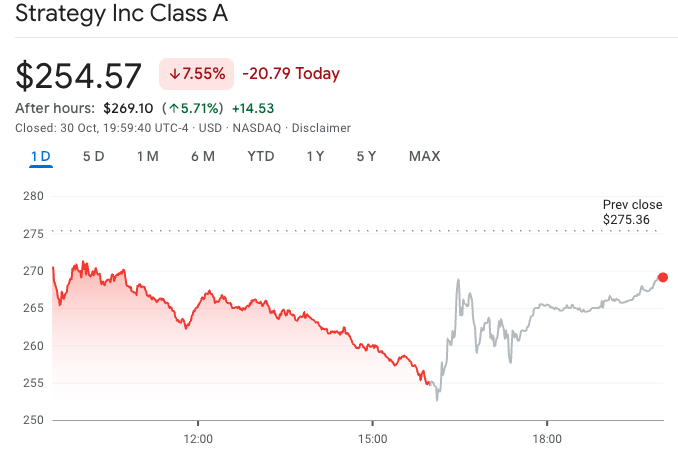

MicroStrategy’s stocks saw a rebound of 5.7% after hours, reaching over $269, despite finishing Thursday’s regular trading session down over 7.5% at $254.57, their lowest point in six months.

Strategy has struggled to gain over the past six months as Bitcoin has remained range-bound around $110,000.

Strategy has struggled to gain over the past six months as Bitcoin has remained range-bound around $110,000.

MicroStrategy holds the largest Bitcoin reserves among publicly traded companies, and the cryptocurrency’s rise of over 6.5% during the third quarter has positively impacted the company’s profits. Currently, Bitcoin is trading down by 1.7% within the last 24 hours, stabilizing at $108,500 after dipping below $106,500.

Related: Coinbase adds $300M Bitcoin as it pushes ‘Everything Exchange’ vision

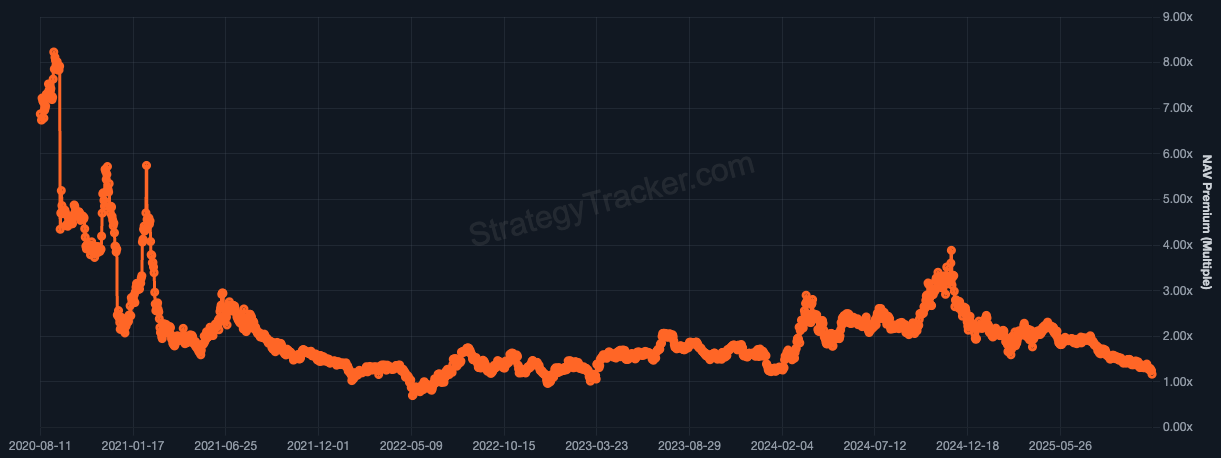

The recent decline in Bitcoin’s price and the dip in MicroStrategy’s stock have reduced its market NAV to 1.05x, a significant fall from its peak of 3.89x in November following Bitcoin’s surge after Donald Trump’s election victory, according to data from StrategyTracker.

Strategy’s mNAV has fallen to its lowest level since early 2023.

Strategy’s mNAV has fallen to its lowest level since early 2023.

MicroStrategy reported a Bitcoin yield of 26% so far this year, reflecting a $13 billion gain, and confirmed its annual target of achieving a 30% yield, estimating Bitcoin will hit $150,000. The company has accumulated 42,706 BTC over the third quarter, bringing its total to 640,031 BTC by September 30, which has since increased to 640,808 BTC as of Sunday, at an average purchase cost of $74,032.