Dogecoin Falls Below Essential Support – Yet a Bullish Breakout Might Be Ahead

Amid whale sell-offs and diminishing momentum, Dogecoin experiences a 14% drop over the week, but analysts are detecting a potential breakout pattern.

Dogecoin has recently faced downward pressure, suffering a decline of over 14% during the past week, including a 6% dip within the last 24 hours, causing its price to hover around $0.174 amid a broader market retreat.

Technical Indicators Suggest Familiar Pattern

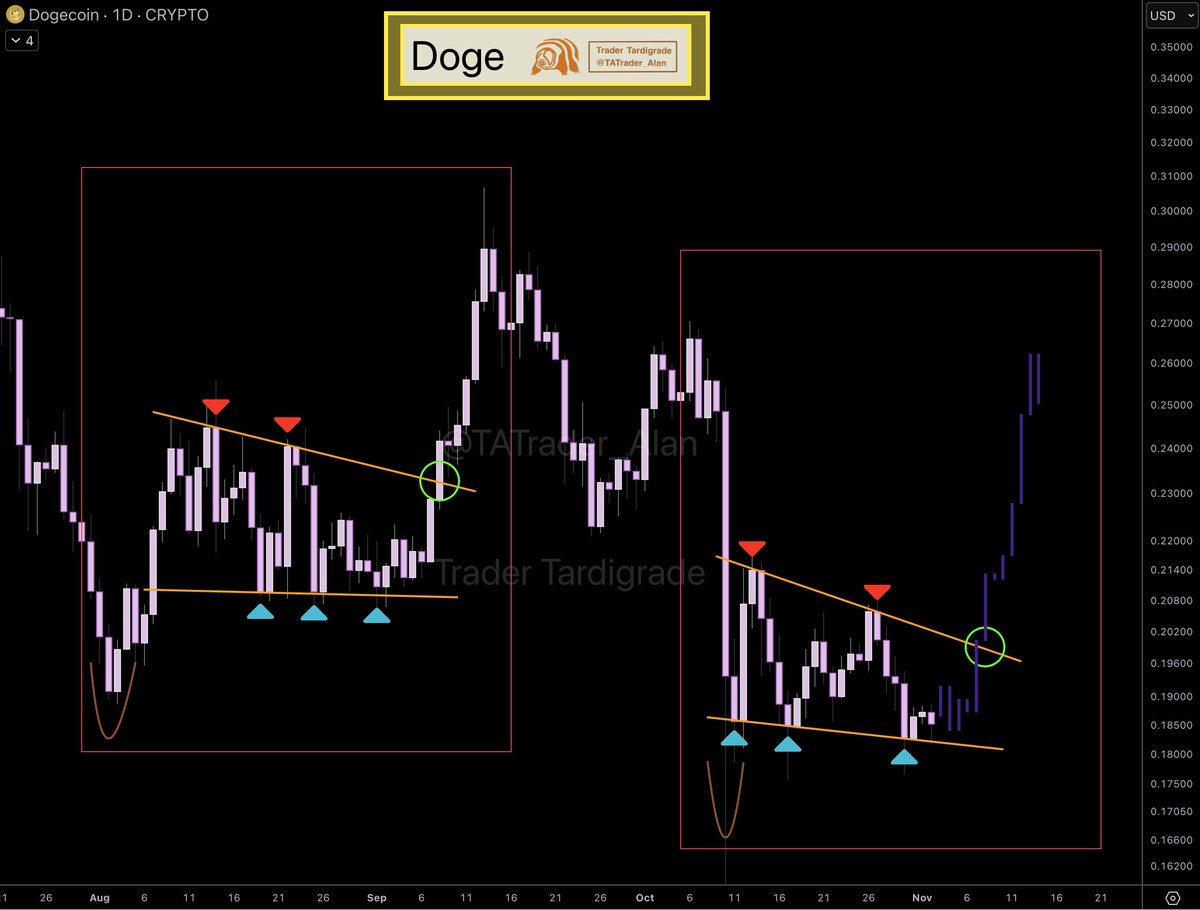

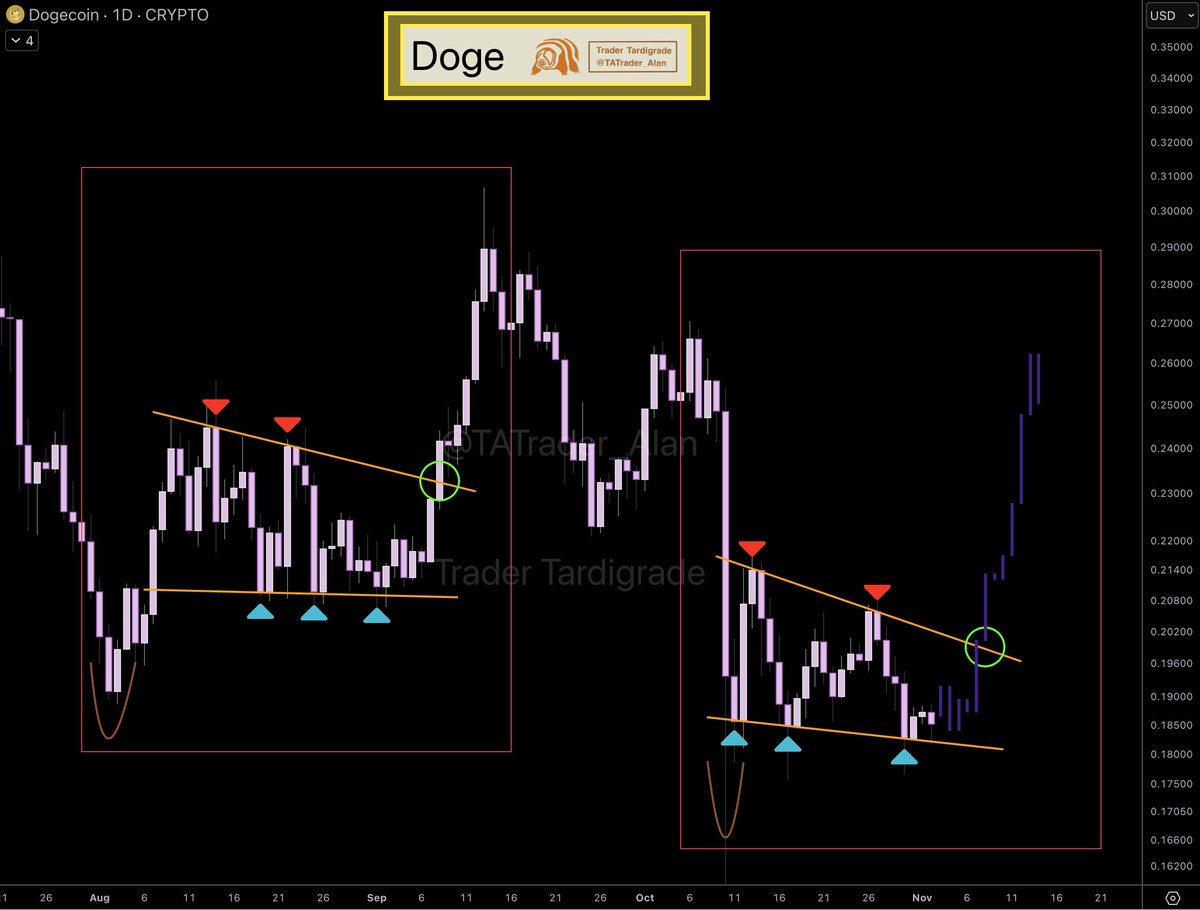

Analyst Trader Tardigrade has highlighted a familiar pattern on Dogecoin’s daily chart, recognized as a descending contracting wedge, characterized by three touches on its lower support line and two on the upper resistance line. This setup mirrors a formation seen in August which resulted in an upward breakout.

Dogecoin Wedge Chart

Source: Trader Tardigrade/X

Dogecoin Wedge Chart

Source: Trader Tardigrade/X

The current wedge formation developed from late October to early November could signal a potential rise if historical patterns hold true, suggesting possible price movement towards the $0.26 to $0.28 range. However, the actual direction will depend on trading volume and participation.

In addition, Tardigrade shared a broader monthly perspective indicating a long-term rounding bottom pattern, which, if validated, could suggest a future price target around $4.14, although this does not imply immediate changes.

Indicators Point to Weak Momentum

On the daily chart, the Relative Strength Index (RSI) is currently at 35, nearing oversold levels that might lead to stabilization or a brief bounce. Bollinger Bands reveal the asset trading below the lower band, hinting at possible increased volatility or selling exhaustion. Presently, the 20-day moving average is positioned at $0.19185, with Dogecoin trading below this mark.

Analyst Ali Martinez identified $0.18 as a significant support level, tagging it as a ‘strong buy-the-dip’ zone, but with the current trading below this threshold, the resilience of Dogecoin will be tested.

Whale Activity and Market Sentiment

Recent whale movements revealed large-scale sell-offs, with wallets holding between 10 and 100 million DOGE shedding 440 million tokens within three days. This selling trend has intensified downward price pressure and may have prompted smaller investors to sell as well.

Currently, the open interest in Dogecoin futures is recorded at $1.67 billion, significantly less than its previous peak of over $6 billion. Diminished open interest suggests reduced trading activity and leverage, contributing to a lack of strong directional momentum for Dogecoin.