Morgan Stanley is gearing up to launch a digital asset wallet in 2026, marking a significant move in its efforts to broaden its crypto investment product offerings. The new wallet will be designed to accommodate cryptocurrencies as well as real-world tokenized assets (RWAs), which include stocks, bonds, and real estate. It is expected to support a wider array of assets over time, as reported by Barron’s.

In September, Morgan Stanley made headlines by announcing that users of the E*Trade brokerage platform, which it owns, would be able to trade cryptocurrencies such as Bitcoin, Solana, and Ether starting in 2026.

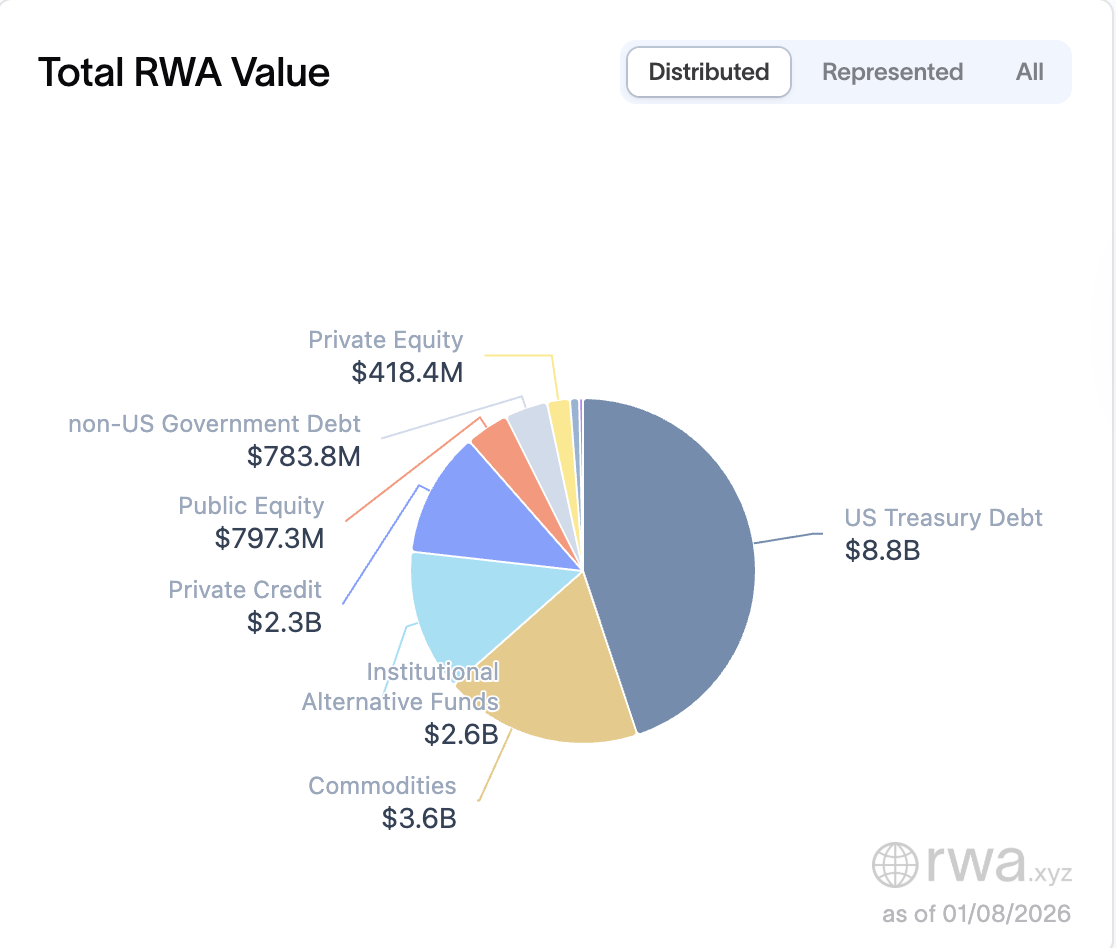

The total value of tokenized real-world assets is broken down by asset class. Source: RWA.XYZ

The total value of tokenized real-world assets is broken down by asset class. Source: RWA.XYZ

Cointelegraph attempted to contact Morgan Stanley for a statement but had not received feedback by the time this article was published. These announcements underscore the growing acceptance of crypto and blockchain technologies by traditional financial institutions.

Related: Morgan Stanley’s Bitcoin ETF could offer strategic value beyond inflows, analysts say.

Morgan Stanley Grows Its Presence in Crypto

Morgan Stanley has revealed several initiatives aimed at enhancing its crypto footprint for 2026, including plans for multiple crypto exchange-traded fund (ETF) filings.

On Tuesday, the company submitted applications to the U.S. Securities and Exchange Commission (SEC) for spot BTC and SOL ETFs, which will be passive investment vehicles that track the spot price of these digital currencies by holding them.

Additionally, Morgan Stanley filed for a staked Ether ETF that will hold spot ETH while staking a portion of the fund’s ETH to generate staking income.

Morgan Stanley’s S-1 form for an Ethereum ETF. Source: SEC

Morgan Stanley’s S-1 form for an Ethereum ETF. Source: SEC

Staking allows token holders to commit their assets to secure proof-of-stake blockchain networks, either directly through transaction validation or via third-party delegation.

Originally, Morgan Stanley targeted its crypto investment products at affluent clients with a minimum of $1.5 million in investable assets. However, in October, it opened access to all clients to invest in its crypto offerings and began advocating for ‘conservative’ crypto allocations. Analysts suggested an allocation of up to 4% for high-risk growth portfolios and a 2% allocation for balanced-risk portfolios.