Traders observe that Ether’s diminishing open interest alongside low futures funding rates may create favorable conditions for a significant short squeeze, potentially pushing prices towards $2,500.

Current Market Situation

Ether (ETH) recently bounced back above $2,000 and continued its upward trajectory following a softer-than-expected US Consumer Price Index (CPI) report. This surge hints at the potential for a positive close in weekly candles for the first time since mid-January, with speculation growing about a jump towards $2,500.

Key Insights:

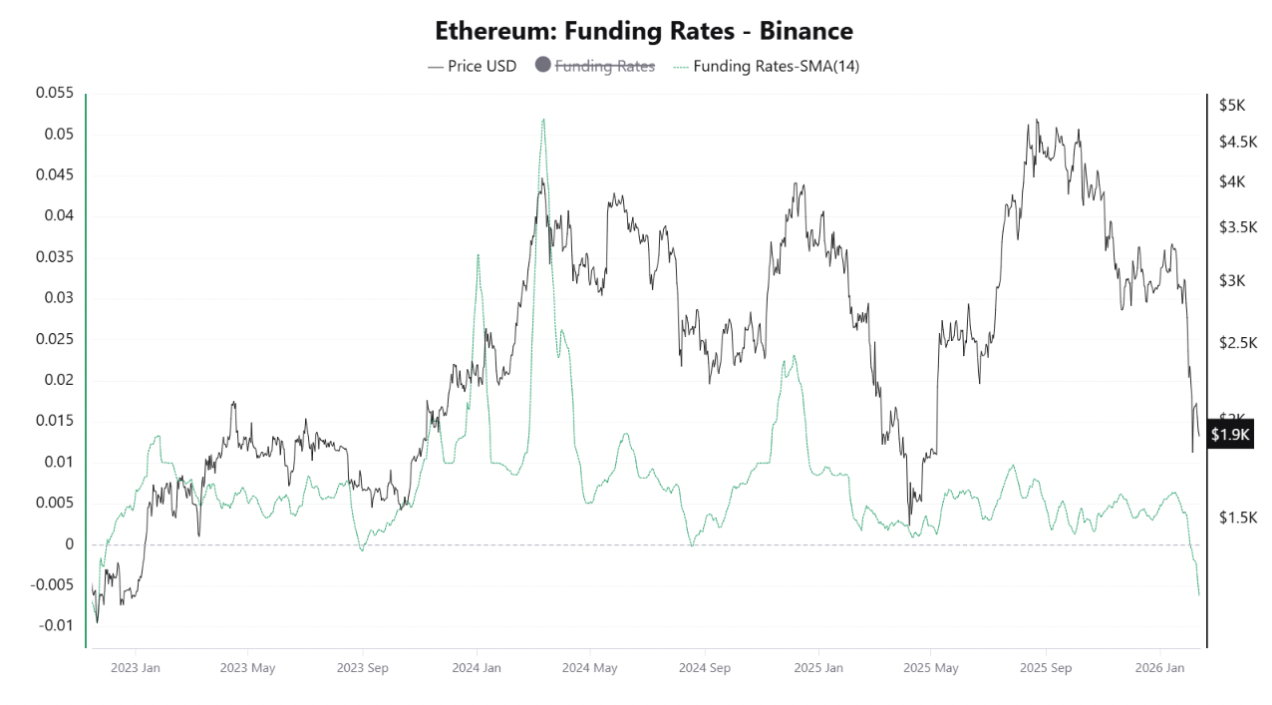

- In the last month, Ether futures’ open interest has plunged by 80 million ETH, with funding rates dipping to three-year lows, signaling a weakening bearish trend.

- The price has found robust support around $2,000, an essential level for sustaining this recovery.

ETH/USD hourly chart. Source: Cointelegraph/ TradingView

ETH/USD hourly chart. Source: Cointelegraph/ TradingView

Ether Open Interest Decline

Recent data reveals a substantial reduction in Ether’s open interest across leading exchanges, notably with Binance reporting a decrease of 40 million ETH (50%) over the past month. Other exchanges such as Gate, Bybit, and OKX have also experienced significant declines, indicating a widespread trend rather than an isolated issue.

CryptoQuant analyst Arab Chain observed that this decline suggests leverage traders are lessening their exposure.

“This environment may pave the way for a period of relative stability or the formation of a more solid price base for Ethereum in the near future.”

As funding rates on Binance reach unprecedented negative levels, CryptoQuant contributor CryptoOnchain noted it reflects the peak of bearish sentiment seen in three years. Historical data shows that extreme negative rates often precede upward price movements, as traders attempting to liquidate late bears could lead to a short squeeze.

“Current data suggests we may be witnessing a classic capitulation event, mirroring the bottom formation of late 2022, potentially setting the stage for a sharp recovery.”

Ether futures funding rates. Source: CryptoQuant

Ether futures funding rates. Source: CryptoQuant

Technical Analysis for ETH Prices

Currently trading at $2,050, ETH has broken out of a falling wedge on its four-hour chart. The calculated target for this move is approximately $2,150. Sustaining prices above the psychological threshold of $2,000 is crucial for further bullish moves.

This article is not investment advice. Always conduct thorough research before making any investment decisions.