Metaplanet CEO Simon Gerovich has refuted accusations posed by critics alleging that the firm concealed losses related to its Bitcoin investments and failed to fully disclose critical information. The backlash has arisen amidst concerns about the company’s leveraged Bitcoin treasury strategy.

Gerovich responded to these claims, particularly from anonymous sources, asserting that Metaplanet has always been transparent regarding its Bitcoin activities. He specified that all Bitcoin transactions, option strategies, and associated borrowings have been timely disclosed.

September Buys and Announcements

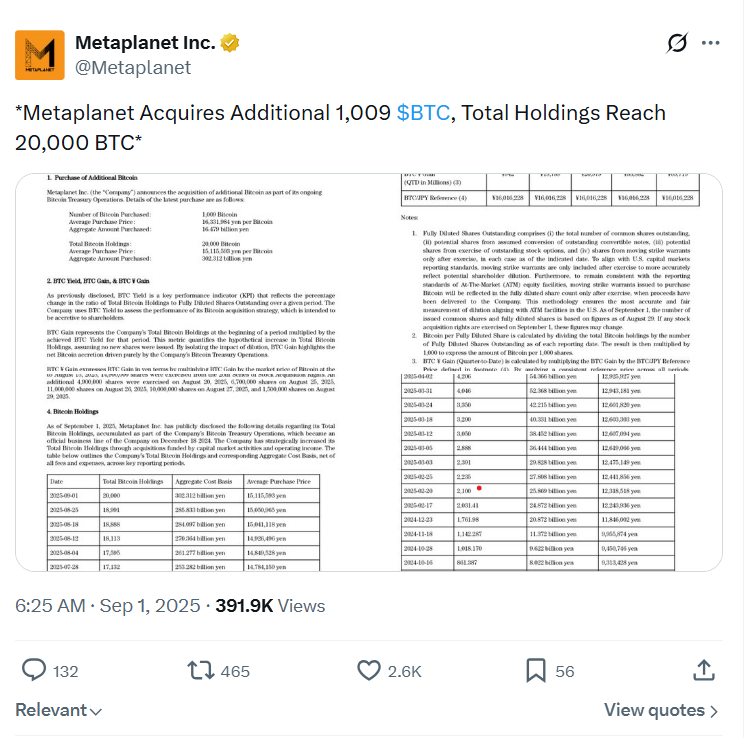

Gerovich emphasized that the company executed four Bitcoin transactions in September 2025, conveniently announcing these purchases. Their public dashboard verifies the acquisitions totaling 1,009 BTC on September 1, 136 BTC on September 8, 5,419 BTC on September 22, and 5,268 BTC on September 30.

Metaplanet announcement of BTC purchase. Source:

Metaplanet announcement of BTC purchase. Source:

Additionally, selling put options was aimed at acquiring Bitcoin at beneficial prices rather than risky short-term bets.

Evaluating Performance

Gerovich also pointed out that using net profit as a performance metric for a Bitcoin treasury company could be misleading. He highlighted a significant increase in Metaplanet’s operational revenue, primarily driven by its Bitcoin-related operations, despite reporting substantial non-cash losses linked to the decline in Bitcoin prices.

Moreover, he noted that the company has disclosed details about its credit facility established in October 2025, covering significant details about borrowings and collateral.

Broader Concerns in the Industry

Gerovich’s statements come at a time when other companies are under scrutiny for their Bitcoin-heavy treasury strategies. Recent reports have shown substantial losses by other firms as the Bitcoin market fluctuates.

While Cointelegraph sought further comments from Metaplanet, no responses were recorded prior to publication.

Related Links:

- Metaplanet sticks to Bitcoin buying plan

- Metaplanet’s revenue surge

- Metaplanet’s US trading debut with Deutsche Bank

Big Questions: Is China hoarding gold so yuan becomes global reserve instead of USD?

Cointelegraph aims to deliver transparent and independent journalism.