CPI Report Signals Potential Bitcoin Price Drop Ahead

An analysis of the latest CPI report and its implications for Bitcoin's market movement.

Recent CPI Report Highlights

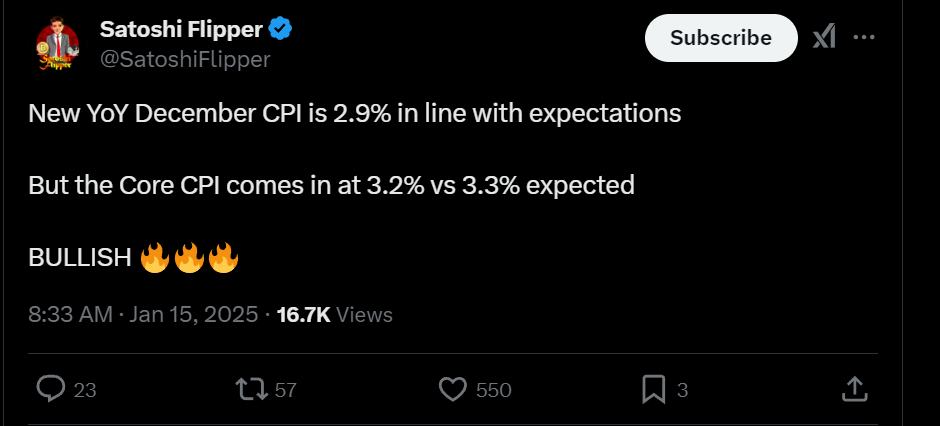

Today’s CPI report has just been released, revealing that inflation has taken a significant dip for the first time since July 2024. This could indicate a major shift in market dynamics following the recent Consumer Price Index (CPI) publication which shows price changes for goods and services.

Market Reaction With December’s CPI indicating a reduction, inflation analysts are observing a potential shift in the market. As inflation slows, attention shifts toward the Federal Reserve’s forthcoming decisions.

CPI Chart

CPI Chart

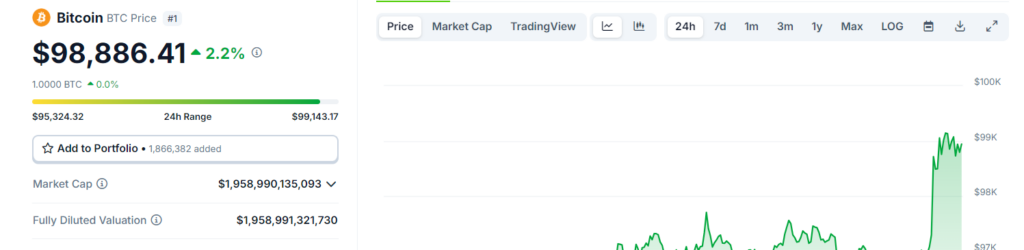

Implications for Bitcoin Bitcoin price saw a quick rebound of 2%, climbing back to $98,000, hinting at market manipulation. Where does Bitcoin head from here? As inflation calms down, Fed Chair Jerome Powell has the options to pause interest rate changes that could affect Bitcoin significantly.

Key Takeaways from the CPI Report

-

Core CPI

- Core CPI has dropped for the first time in months, providing some relief to investors.

-

Federal Reserve Decisions

- The data influences expectations for the Federal Reserve’s actions this month, potentially halting the rate increases.

Market Response

Market Response

Future Outlook

As we gear towards 2025, uncertainty looms over economic implications of new policy changes proposed by former President Donald Trump. Investors remain cautious, indicating the ongoing volatility in Bitcoin and other cryptocurrencies as economic indicators fluctuate.