What to know:

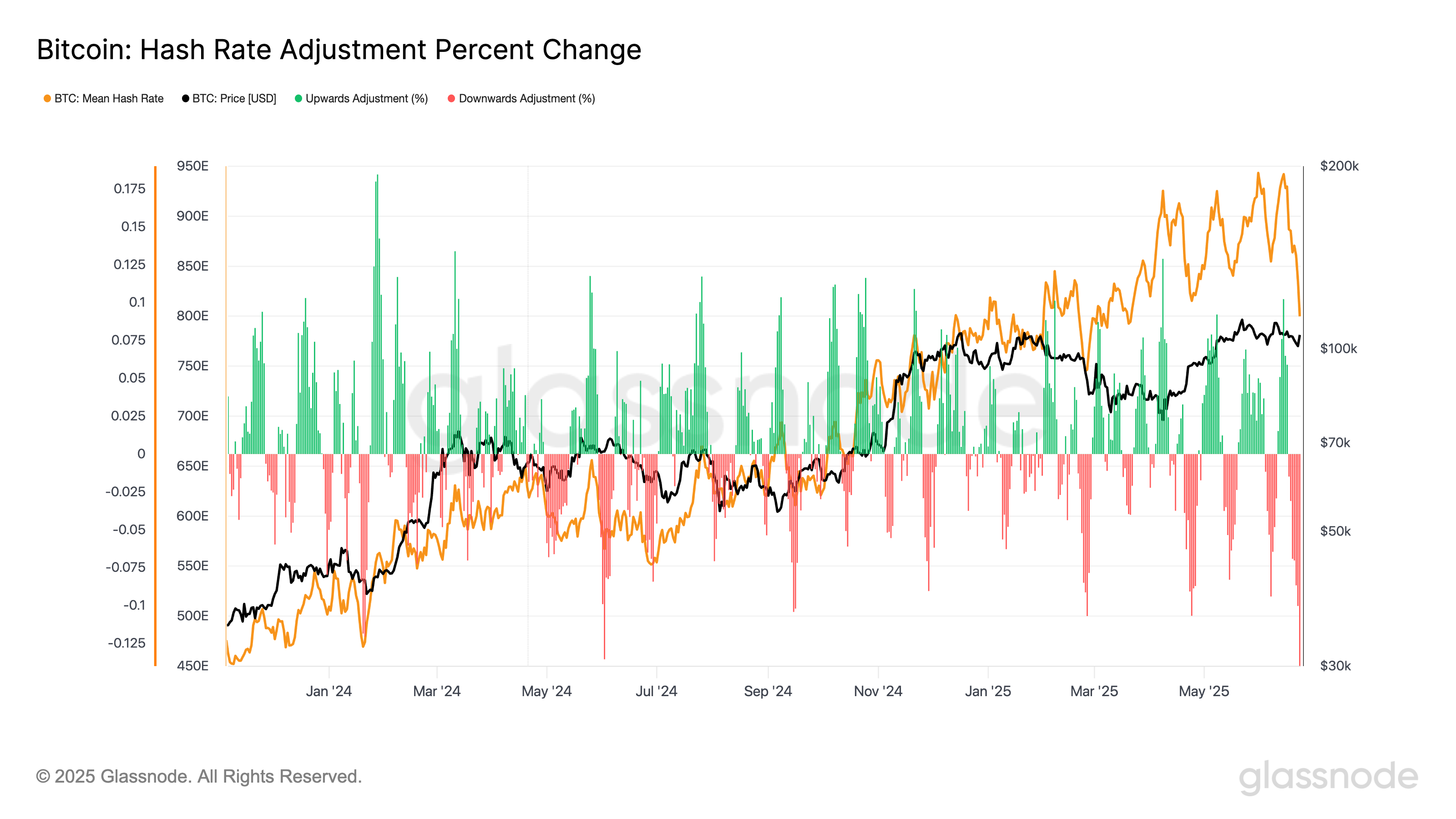

- Bitcoin’s hashrate has declined approximately 30% over a two-week period, dipping below 700 EH/s, marking the steepest decrease since China’s 2021 mining ban.

- A downward difficulty adjustment of about 9% is expected in the next five days, which would improve mining conditions and potentially enhance revenue for miners per exahash.

Mining difficulty on the Bitcoin BTC blockchain is set to experience its most significant decrease since July 2021 due to a roughly 30% drop in mining power securing the network over the past fortnight.

According to Mempool.space, the projection indicates a difficulty adjustment of around 9% within the next five days. This would be significant as it matches the fallout from the 2021 mining ban in China, when the hashrate plummeted by 50%, resulting in Bitcoin trading near the $30,000 mark.

How This Affects Mining

The difficulty adjustments occur every 2,016 blocks to maintain a mining time close to 10 minutes per block. Following the decline, Glassnode reports that the hashrate currently stands at just under 700 EH/s, with Bitcoin recently trading at approximately $105,300.

Such significant corrections in hashrate and difficulty frequently occur during summer months in the northern hemisphere, driven by higher electricity demands from cooling systems, often leading miners to temporarily suspend operations, especially for older or less efficient equipment. This seasonal shift has been acknowledged in previous years.

The anticipated reduction in mining difficulty will provide substantial relief for miners. Currently, the hash price, which measures miner revenue per exahash, stands at $51.9. This figure reflects estimated daily income a miner earns per EH/s contributed to the network, factoring in block rewards and transaction fees. As difficulty drops, mining becomes less challenging, allowing miners to potentially earn more revenue for their computational efforts. Assuming Bitcoin prices and transaction fees hold steady or rise, miners can expect to see hash prices increase significantly in the coming days, mitigating recent pressures on profitability.