BlackRock’s Spectacular Quarter

Record inflows into BlackRock’s cryptocurrency ETFs reinforce the firm’s position in the market as it captures substantial interest from institutional investors looking to invest billions in Bitcoin and Ethereum.

The iShares ETFs, which comprise over 1,400 funds worldwide, secured an astonishing $205 billion in net inflows during the third quarter, according to their quarterly financial statement. This surge led to a 10% organic fee growth for the quarter and an 8% increase year-over-year, as articulated by Chairman and CEO Larry Fink in a statement.

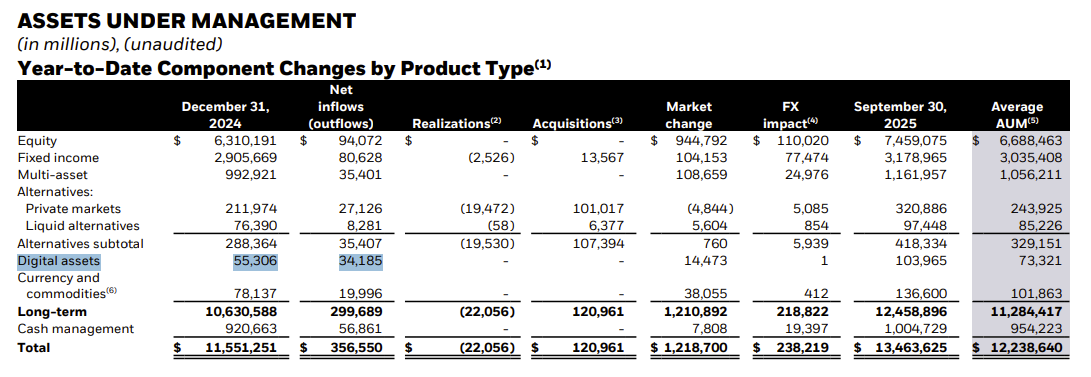

Fink emphasized that BlackRock is “always preparing for the future,” focusing on emerging sectors like technology and digital assets. During this quarter, net inflows into BlackRock’s digital asset ETFs reached $17 billion, bringing the total up to $34 billion for the year. By September, total crypto assets managed by the firm approached $104 billion, accounting for about 1% of its total assets.

Significant Growth

Since the year’s start, the AUM for BlackRock’s digital asset ETFs has expanded dramatically due to vigorous net inflows. Source: BlackRock

Significant Growth

Since the year’s start, the AUM for BlackRock’s digital asset ETFs has expanded dramatically due to vigorous net inflows. Source: BlackRock

These results coincide with the soaring success of the iShares Bitcoin Trust (IBIT), which has notably generated $25 million more in fees than the second-most lucrative ETF from BlackRock and is presently approaching $100 billion in net assets as of early October.

IBIT was part of the initial wave of spot Bitcoin (BTC) ETFs approved by the US Securities and Exchange Commission in early 2024. Later that year, BlackRock introduced the iShares Ethereum Trust (ETHA), which, after an initial slump, gained substantial traction in 2025 to become the third-fastest fund to reach $10 billion.

In total, BlackRock’s sustained increase in assets was reflected in its reported AUM of $13.46 trillion, marking a 17% rise compared to the previous year, with both earnings and revenue exceeding what analysts anticipated for the quarter.